- LP Corner: Private Equity Fund Performance – An Overview

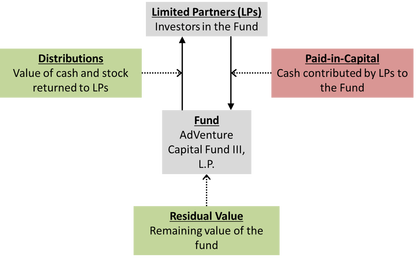

- LP Corner: Fund Performance Metrics – Multiples TVPI, DPI and RVPI

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part One

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part Two - This blog post

- LP Corner: Fund Performance Metrics – Public Market Equivalent (PME)

- LP Corner: Fund Performance Metrics - Private Equity Fund Performance

- LP Corner: Gross vs Net Returns

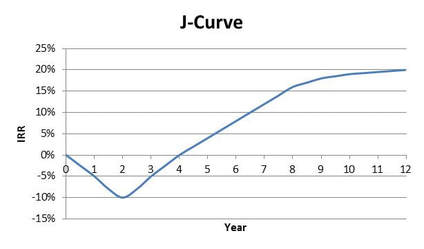

In this post, we will explore internal rate of return (IRR) as a tool for evaluating fund performance metrics.

Recap

In my prior post, we discussed the basics of IRR in a fund context. In this post, we build on that to explore what happens year by year for that fund.

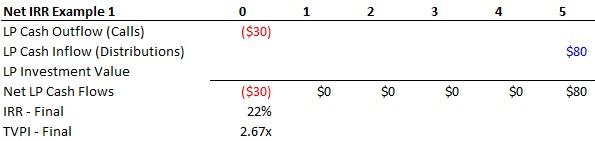

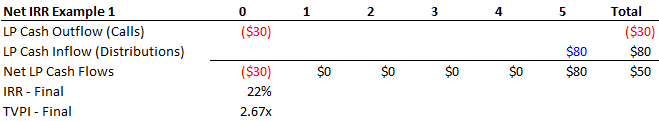

In Example 1 in the last post, we introduced a fund, where the LP paid $30 million to the fund in a capital call at time = 0 and received $80 million back from the fund (as distributions) at the end of year 5. These simple cash flows yielded an IRR of 22% and a TVPI of 2.67x.