I recently spent time in China meeting with venture capital funds, and agree with much of what Mr. Gai has to say. I'd add a couple of thoughts from the perspective of an LP considering investing in China-based venture capital funds:

- Huge market opportunity. The Chinese domestic market is massive and growing rapidly.

- Massive competition. As Mr. Gai points out in his presentation, competition at the startup level is "endless" and as he puts it, "it's pure insanity."

- Regulatory environment adds challenges to startups and to venture capital funds.

- Corporate governance has improved over the past several years, but remains an issue.

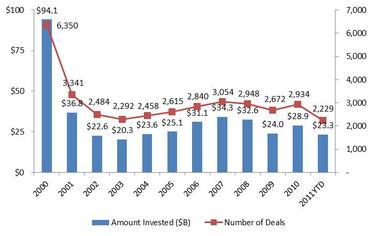

- There are huge amounts of money being invested in Chinese venture capital funds. Is there a bubble forming?

- Valuation creep, especially at the growth stage.

- Liquidity issues. M&A is not as prevalent in China as in the US (perhaps due to lifestyle issues mentioned by Mr. Gai), and the pace of venture-backed IPOs is slow relative to the number of venture-funded companies. This means that venture capital funds aren't able to achieve exits as easily or quickly as expected, which leads to...

- Long holding periods for VCs and reduced IRRs to LPs. Time from initial investment to exit is climbing (see above), reducing net IRRs to LPs.