Link: http://fortune.com/2016/02/20/venezuela-oil-bolivar/

|

I am fascinated by closed economies. One of these is Venezuela, where the main driver of the economy has been oil. However, Venezuela's economy is ravaged by hyper-inflation, chronic shortages of basic goods, stifling currency controls, and plummeting global oil prices. A recent Fortune article "4 Steps To Fix Venezuela's Economy" outlines the economic problems the country faces, and proposes four steps to stabilize the economy. It's an interesting article, and worth a read.

Link: http://fortune.com/2016/02/20/venezuela-oil-bolivar/

0 Comments

In a prior blog post called "Unemployment, Employment and the Participation Rate," I explored several different metrics used to evaluate the health of the economy. One of those is the participation rate, which measures the percentage of the labor force (those aged 16 and older) that are working or actively seeking work. This metric has been declining over time, which could signal weakness in the economy.

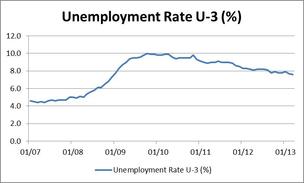

Yesterday's post on Seeking Alpha "Declining Participation Rate a Function of a Weak Labor Market" discusses this a but more and points out that some economists attribute the decline to an increase in the retirement of baby boomers. The article compares our economy to that of the United Kingdom, which also has baby boomers, and concludes that the decline in the participation rate is not due to an increase in the retirement of baby boomers. It's an interesting article and worth a read. Link to my prior post on Unemployment, Employment and the Participation Rate: http://www.allenlatta.com/allens-blog/unemployment-employment-and-participation-rate Link to Seeking Alpha article: http://seekingalpha.com/article/2715165-declining-participation-rate-a-function-of-a-weak-labor-market?ifp=1  The unemployment rate recently dropped to 7.6 percent, which on its face sounds good. However, the economy only added 88,000 jobs in March, well below expectations. Given this dichotomy, I wanted to add a few of my own thoughts on unemployment rates, employment and the participation rate. Official Unemployment Rate (U-3). In my opinion, focusing on the official employment rate as issued by the Bureau of Labor Services (BLS) provides an incomplete (and potentially misleading) picture of the unemployment situation. This headline rate is known as the U-3 unemployment rate, and focuses on people out of work that have actively sought work in the past four weeks. According to the BLS: "Persons are classified as unemployed if they do not have a job, have actively looked for work in the prior 4 weeks, and are currently available for work." It ignores people that have stopped looking for work or people that are working part-time but who want to work full-time. The chart to the right shows the U-3 unemployment rate from 2007 to present, with the peak of 10% unemployment during the recent recession (data from the BLS website). U-6 Unemployment Rate. The U-6 unemployment rate is based on the U-3 unemployment rate and adds people who are "marginally attached workers" and part-time workers who want to work full-time but cannot due to economic reasons. This broader measure of unemployment captures underemployed workers, but still excludes people who have given up on looking for work and so are not considered to be part of the workforce. This could be people who have retired or have simply given up looking for work because they couldn't find a job. This U-6 measure of unemployment was 13.8% in March 2013, down from a peak of 17.1% in October 2009. This data is not easy to find on the BLS website, but here's the link: http://www.bls.gov/webapps/legacy/cpsatab15.htm Employment. The BLS also publishes employment data, with the non-farm payroll employment data being the most commonly used. For example, the recent headlines that the economy added 88,000 jobs refers to non-farm payrolls (here's a link to the recent BLS announcement: http://www.bls.gov/news.release/empsit.nr0.htm). According to preliminary numbers from the BLS, non-farm payroll employment reached 135,195,000 in March 2013, up from a low of 129,320,000 in February 2010. Many economists estimate that it takes a monthly increase in employment of at least 150,000 for the workforce to keep up with population growth. Labor Force Participation Rate. The labor force participation rate measures the percentage of the labor force that is working or actively looking for work. The labor force in the US is defined by the BLS as people aged 16 and over. According to the BLS, the Labor Force Participation rate fell to 63.3% in March 2013, down from a high of 67.3 in early 2000. The Labor Force Participation Rate has trended down since 2000, but the pace of decline picked up in the latest recession. There's a good article on the blog Calculated Risk discussing the Labor Force Participation Rate - here's the link: http://www.calculatedriskblog.com/2013/04/labor-force-participation-rate-update.html?. Here's a good discussion on Seeking Alpha on how declining labor force participation could actually be good for workers: http://seekingalpha.com/article/1330171-could-there-be-a-silver-lining-to-declining-labor-force-participation? Payroll to Population (P2P) Rate. Another measure of employment (or unemployment) is the Gallop US Payroll to Population Rate (P2P). This metric "is an estimate of the percentage of the U.S. adult population aged 18 and oder who are employed full time by an employer for at least 30 hours per week. P2P is not seasonally adjusted." (Source: http://www.gallup.com/poll/161624/payroll-population-rate-stagnant-march.aspx.) According to Gallup, the P2P was 43.4% in March 2013, unchanged from 43.3% in February 2013. Another similar measure is the employment-to-population ratio (aka employment-population ratio). When I'm trying to understand unemployment, these are the measures that I use. So for example, the way I read the current release is that the drop in the official unemployment rate is misleading. The economy only added 88,000 non-farm jobs when 150,000 new jobs are needed just to keep up with population growth. So the pace of hiring has slowed down. Also, the decline in the participation rate tells us that more people are leaving the work-force, whether by retirement or going back to school (a popular route for younger workers) or other reasons. So in all, despite an improving official unemployment rate, the economy has taken a step back. Thoughts? Please send me a note. Did you know that outstanding student loan balances in the US total $870 billion, more than outstanding US credit card balances ($693 billion) or US auto loan balances ($730 billion)? Further, the outstanding student loan balance is growing, while other consumer credit is declining or remaining flat. This is according to the post "Grading Student Loans" on the Federal Reserve Bank of NY's Liberty Street Economics web page. The concern is that the amount of student loan debt is causing a drag on the economy.

According to the Forbes article "The Next Crisis to Avoid is in Student Loans," the concern is the high amount of student loan debt combined with a weak job market adds pressure to the economy. Specifically, this could be impacting first-time home buyers, as borrowers in their 30's have the highest average student loan debt balance at $28,500. There's much more to the issue that is contained in the articles. Here's the link to the "Grading Student Loans" post: http://libertystreeteconomics.newyorkfed.org/2012/03/grading-student-loans.html Here's the link to the article "The Next Crisis to Avoid is in Student Loans" from Forbes: http://finance.fortune.cnn.com/2012/03/06/student-loan-crisis/ The NY Times has posted an article "Big Data's Grass-Roots Revolution" which discusses how the incredible volumes of data that is being generated can be analyzed by regular folks like you and me. There's also a video by Google's Chief Economist, Val Varian, from the Strata 2012 conference on how one can use Google data for economic forecasting. The beginning of Mr. Varian's speech discusses the correlation of searching for vodka and searching for hangovers.

Here's the link to the NYTimes.com story: http://bits.blogs.nytimes.com/2012/03/02/big-datas-grassroots-revolution/ Link to Hal Varian's talk "Using Google Data for Short-Term Economic Forecasting" at Strata 2012: http://www.youtube.com/watch?feature=player_embedded&v=-I8acYHQ0v0 Eliot Spitzer, when he was Attorney General of New York, negotiated a universal settlement with Wall Street banks that, among other things, prohibited equity research analysts from participating in underwriting activities. The San Francisco Chronicle has an interview with Mr. Spitzer on the impacts of financial regulation. The story can be found here: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/11/19/BUUA1M0II9.DTL

An opinion column by Dean Garfield and Dendy Young that appeared on today's US News website provides their insights on what would help keep innovation in the US strong and robust, helping to improve the US economy. Here's the link: http://www.usnews.com/opinion/articles/2011/11/11/encouraging-venture-capitalism-key-to-economic-growth. Mr. Garfield is the president and CEO of the Information Technology Industry Council. Mr. Young is the managing partner of McLean Capital, a private equity firm, and the former CEO of GTSI Corp.

In this piece, Mssrs. Garfield and Young list three items they feel will help the US maintain its innovation advangate:

I generally agree with the points made in this piece, but would add the following two items:

The US economy's growth will probably be "frustratingly slow", according to Fed Chairman Ben Bernanke, Fox News reports. The Fed now estimates that the US economy will grow from 1.6% to 1.7% for 2011 and 2.5% to 2.9% in 2012, which estimates are roughly a point below the Fed's estimates in June. Unemployment is expected by the Fed to be between 8.5% and 8.7% in 2012, down from the current rate of 9.1%. Here's a link to the Fox story: http://www.foxnews.com/politics/2011/11/02/bernanke-pace-economic-growth-to-be-frustratingly-slow/.

According to The Wall Street Journal, Bernanke also signaled that the Fed is ready to do more to help the economy, such as through the purchase of additional mortgage-backed securities to aid the weak housing market. Here's the link to the WSJ.com story (behind subscription firewall): http://online.wsj.com/article/SB10001424052970203804204577013900433130614.html?mod=WSJ_hp_LEFTWhatsNewsCollection To me, this is all mixed news. Given the turbulence in Europe with the Greek sovereign crisis, Asia's slowing economy, and the lingering weakness in the US economy, it wouldn't take much to derail the slight US recovery. I'm hopeful that Europe is able to contain the Greek crisis, that Italy can address its economic issues, and that the US economy continues to grow. These would be nice holiday presents to us all. The November 2011 edition of Vanity Fair magazine contains a Michael Lewis article entitled "California and Bust." Here's a link: http://www.vanityfair.com/business/features/2011/11/michael-lewis-201111. In this article, Mr. Lewis describes the dismal financial condition of California, both at the state and local level. To me, it highlights the difficulties we face as a state, and how difficult it will be to change the situation. The article also introduces me to a term that I'm going to try to incorporate into my vocabulary: lizard-brained.

In my view, the Michael Lewis article echoes the article "California reelin'" which appeared in the Economist in March 2011. Here's a link: http://www.economist.com/node/18359882. The Economist article examines some specific causes of the problems that now exist in California and is an interesting read. |

About this Blog

This Blog is a collection of thoughts on a variety of topics of interest to me, including: Categories

All

Archives

January 2024

Copyright Notice:

All original works on this site are © Allen J. Latta. All rights reserved. Neither this website nor any portion thereof may be reproduced or used in any manner whatsoever without the express prior written permission of Allen J. Latta. LP Corner® is a registered trademark of Campton Private Equity Advisors. Used with permission. DISCLAIMER: Readers of this Blog are not to construe it as investment, legal, accounting or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Readers should consult with their own investment, legal, accounting, tax and other advisors to the determine the benefits and risks of any investment.

Private equity investments involve significant risks, including the loss of the entire investment. This Blog does not constitute an offer to sell or the solicitation of an offer to buy any security. |