Starting January 1, 2023, most privately owned corporations, LLCs, limited partnerships, LLPs and other companies, as well as the officers, directors, managers, general partners, and 25% owners of these companies, will be subject to new federal reporting requirements imposed by the Corporate Transparency Act. This article provides an overview of this new, onerous law.

1. Overview

The Corporate Transparency Act (the “CTA”) was enacted in 2021 as an expansion of federal laws that combat money laundering, terrorist financing, tax fraud and other illegal activities. The CTA requires “reporting companies” to provide the federal government with information on certain “beneficial owners” and “company applicants.” The governmental agency tasked with implementing the CTA is the Financial Crimes Enforcement Network, or FinCEN, which is a bureau of the Department of Treasury. FinCEN’s website is found at www.fincen.gov. The CTA becomes effective on January 1, 2024.

The information reported to FinCEN will be confidential and maintained in a non-public database maintained by FinCEN. The information may be shared by FinCEN with federal and state law enforcement agencies, foreign law enforcement agencies, the Department of Treasury (including the IRS), foreign law enforcement agencies and financial institutions.

The CTA is an onerous and complicated law. While this article provides an overview of the CTA, you are urged to review the CTA’s requirements with your attorney.

At the end of this article there are links to resources regarding the CTA.

2. Impact and Burden

FinCEN estimates that over 32 million domestic and foreign companies will be required to report beneficial ownership information under the CTA when it becomes effective on January 1, 2024, and that five million new companies formed each year will meet the definition of Reporting Company. FinCEN also estimates the time required to complete the report to range from 90 minutes for the simplest of companies to approximately 650 minutes (almost 11 hours) for more complex entity structures. The bottom line is that a massive number of companies will be required to comply with this burdensome law. There are also penalties for non-compliance.

3. Framework

The CTA requires:

- Reporting Companies;

- To identify Beneficial Owners and Company Applicants;

- To collect information from them;

- And report that information to FinCEN;

- Within certain timeframes;

- Or penalties may apply.

Let’s explore each of the above elements, starting with understanding what is a “Reporting Company.”

4. Reporting Companies

Generally speaking, many privately-held companies fall within the definition of a “Reporting Company.” There are two types of Reporting Companies: Domestic Reporting Companies and Foreign Reporting Companies. There are also many exemptions from being a Reporting Company.

Domestic Reporting Companies. A “Domestic Reporting Company” is any entity that is created by the filing of a document with a secretary of state or a similar office under the law of a state or an Indian tribe. Domestic Reporting Companies include:

- Corporations, including venture capital-backed companies and professional corporations.

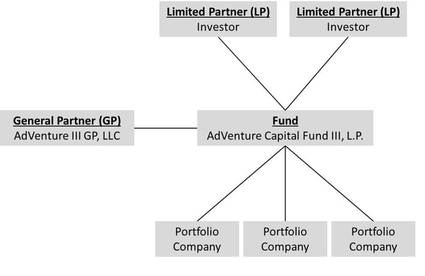

- Limited partnerships, including those formed as venture capital, private equity or real estate funds or projects;

- Limited liability companies (LLCs), including those formed by investors to hold investments or real estate, or those formed to be operating companies (including consulting companies);

- Limited liability partnerships (LLPs), including those formed by law firms;

- General partnerships that are formed by filing a document with a state (such as in Delaware); and

- Other entities formed by filing a document with a state, including certain business trusts.

Note that all of the above companies are formed by filing a document with a state or Indian tribe. Because the CTA covers only companies that are formed by filing a document with a state or Indian tribe, the CTA does not cover sole proprietorships, as sole proprietorships aren’t formed by filing a document with a state. Also, many states don't require a filing for the formation of a general partnership; in these states, including California, general partnerships are not covered by the CTA (but consult with your attorney about this).

Foreign Reporting Companies. A “Foreign Reporting Company” is any entity formed under the law of a foreign country, and registered to do business in any U.S. state or in any tribal jurisdiction by the filing of a document with a secretary of state.

Exemptions from Being a Reporting Company. There are many exemptions from being a Reporting Company. These include:

- Publicly-traded companies;

- Any “large operating company” which (1) employs more than 20 full-time employees in the US, (2) has an operating presence at a physical office in the US, and (3) has over $5 million in annual gross receipts or sales;

- Certain venture capital fund advisers;

- Certain accounting firms;

- Certain companies registered or chartered with the federal government, including certain banks, credit unions, other financial institutions, Broker-Dealers (such as investment banks and stock brokerages), investment companies and investment advisers; and

- Certain tax-exempt entities, including certain 501(c)(3) organizations;

Also, as noted above, sole proprietorships are not covered by the CTA.

Once it is determined that a company is a Reporting Company and no exemption applies, the next step is for the Reporting Company to identify its Beneficial Owners and Company Applicants.

5. Beneficial Owners and Company Applicants

The CTA requires Reporting Companies to identify Beneficial Owners and Company Applicants, to collect certain information about them, and to report this information to FinCEN.

Beneficial Owners. A Beneficial Owner is generally any individual who directly or indirectly exercises “Substantial Control” over the Reporting Company or who owns or controls at least 25% of the ownership interests of the Reporting Company. Stated another way, an individual is a Beneficia Owner if they directly or indirectly:

- Exercises Substantial Control over the Reporting Company; OR

- Owns or controls at least 25% of the ownership interests of the Reporting Company.

Substantial Control. An individual directly or indirectly exercises Substantial Control over a Reporting Company if the individual:

- Is a “senior officer” of the Reporting Company. A “senior officer” is a chief executive officer, president, chief financial officer, general counsel, chief operating officer, or any other officer who performs a similar function regardless of their title.

- Can appoint or remove any senior officer or a majority of the board of directors or similar body.

- Has substantial influence over important decisions made by the Reporting Company, including the sale or merger of the Reporting Company, major expenditures, issuances of equity, incurrence of significant debt, approval of the operating budget, amendments of governance documents, and more.

Substantial control can be exercised directly or indirectly, such as through:

- Representation on the board of directors (or other similar body)

- Owning or controlling a majority of the voting power or voting rights of the Reporting Company

- Rights associated with financing agreements. In many financing agreements, such as venture capital financing agreements, investors typically have the right to appoint one or more of the directors, and the company typically has to obtain the consent of investors to do certain actions. The rights granted to investors under these agreements may be “substantial control” over the Reporting Company.

Owns or Controls 25% of the Ownership Interests of the Reporting Company. An individual is deemed to be a beneficial owner if the individual, directly or indirectly, owns or controls at least 25% of the “Ownership Interests” of the Reporting Company. The definition of ownership interests is complex, but the basics are as follows. An “ownership interest” is:

- Any equity, stock, joint venture interest, certificate of interest in a business trust, regardless of whether the interest is voting or non-voting.

- Any capital or “profit interest” in an entity (this includes ownership interests in an LLC or limited partnership; profit interests are common incentive compensation vehicles for LLCs).

- Any instrument that converts into any of the above, such as a convertible note, a Simple Agreement for Future Equity (SAFE), convertible preferred stock, options, warrants, and the like.

- Certain puts, calls, straddles and other similar instruments.

- Any other instrument or arrangement used to establish ownership.

Note also that if a 25% owner of a Reporting Company is itself an entity, then the CTA appears to require the Reporting Company to obtain from this 25% owner the beneficial ownership information for that 25% owner and submit this information to FinCEN. This is because of Reporting Company must report direct or indirect Beneficial Owners.

Calculating the Total Ownership Interests. The calculation of the 25% ownership interest is also complicated, but for corporations the percentage of ownership is the greater of:

- The total combined voting power of all classes of ownership interests owned by the individual as a percentage of the total outstanding voting power of all classes of ownerships; and

- The total combined value of the ownership interests of the individual as a percentage of the total outstanding value of all classes of ownership interests.

Company Applicants. The CTA also requires Reporting Companies to report information on “Company Applicants.” The definition of Company Applicant is different for Domestic Reporting Companies and for Foreign Reporting Companies.

- For a Domestic Reporting Company, a Company Applicant is (1) an individual who directly files the document that creates the Domestic Reporting Company, and (2) the individual who is primarily responsible for directing or controlling the filing if more than one individual is involved.

- For a Foreign Reporting Company, a Company Applicant is (1) an individual who directly files the document that first registers the Foreign Reporting Company with a state or tribunal, and (2) the individual who is primarily responsible for directing or controlling the filing if more than one individual is involved.

Practically speaking, a Company Applicant is the person who does the filing and any person who directs the filing. This can be an attorney who formed the company, a person who makes the filing on their own (as many entrepreneurs do), or the person supervising the filing. The CTA only requires that Company Applicants for Reporting Companies formed on or after January 1, 2024 to be reported.

Now that we know what a Reporting Company is, and who is a Beneficial Owner, let’s turn to the information that must be collected by the Reporting Company and submitted to FinCEN.

6. Information Required to be Collected and Reported to FinCEN

The Reporting Company must collect and report information on itself and on each Beneficial Owner.

Reporting Company Information. The information required to be reported by the Reporting Company includes:

- The full legal name of the Reporting Company;

- Any trade name or “doing business as” (DBA) name of the Reporting Company;

- If the Reporting Company has a principal place of business in the US, the street address of the Reporting Company’s principal place of business, otherwise the street address of the primary location in the US where the Reporting Company does business;

- The state, tribal, or foreign jurisdiction of formation of the Reporting Company, and for Foreign Reporting Companies, additionally the state or tribal jurisdiction in the US where the Foreign Reporting Company first registered.

- The taxpayer identification number (TIN) including the Employee Identification Number (EIN) for a Domestic Reporting Company, and for a Foreign Reporting Company a tax identification number issued by a foreign jurisdiction and the name of the jurisdiction.

Beneficial Owner and Company Applicant Information. In addition to the above, a Reporting Company must also collect the following from each individual who is a Beneficial Owner or a Company Applicant:

- The individual’s full legal name;

- Date of birth;

- Residential street address;

- For Company Applicants who form or register entity in the course of their business (such as attorneys and entity formation companies), the street address of such business;

- A unique identifying number and issuing jurisdiction from one of the following:

- A current driver’s license and state of issue;

- A current US passport;

- Aa current personal identification document issued by a state, local government, or Indian tribe (such as an ID card issued by a state);

- For foreign individuals who don’t have a US driver’s license, a US passport or a personal identification document, a current passport number from a passport issued by a foreign government to the individual; and

- An image of the document from which the unique identifying number was obtained.

Reporting Companies don’t have to collect or report information on Company Applicants for companies formed before January 1, 2024.

There are also special rules for the following:

- Reporting companies owned by an entity that is exempt from the CTA’s reporting requirements (see above for exemptions from the CTA);

- Minor children; and

- Foreign pooled investment vehicles, such as foreign mutual funds, hedge funds and private equity funds.

FinCEN Identifier. The CTA allows individuals to request a unique identifier from FinCEN (a “FinCEN Identifier”) so that they can provide this FinCEN Identifier to Reporting Companies in lieu of providing the required beneficial ownership information to the Reporting Company. To obtain a FinCEN Identifier, the individual will be required to submit the beneficial ownership information directly to FinCEN via an online form. Once a FinCEN Identifier is issued to an individual, the individual can provide the FinCEN Identifier to a Reporting Company in lieu of the required information. This seems to provide individuals who obtain a FinCEN Identifier with a certain amount of privacy in that they provide the FinCEN identifier to a Reporting Company and not the required beneficial ownership information. Note that the individual is responsible to keep the beneficial ownership information submitted to FinCEN up to date, or potentially face penalties and fines. Any changes to the beneficial ownership information reported to FinCEN must be updated within 30 days after the date the change occurs. Note that Reporting Companies may also request a FinCEN Identifier.

Reporting the Information. The beneficial ownership information will be reported to FinCEN via an online form. The details on the form have not yet been finalized. Essentially, Reporting Companies will collect the beneficial ownership information and upload that information via the government website.

7. Timeframes

Filing of Initial Report. The timeframes for filing the initial beneficial ownership information (BOI) report are different for Reporting Companies formed prior to January 1, 2024, and those Reporting Companies that are formed on or after January 1, 2024.

For those Reporting Companies formed prior to January 1, 2024, the initial BOI report must be filed not later than January 1, 2025. Thus, companies formed prior to January 1, 2024 have a full year to comply with the CTA.

For those Reporting Companies formed prior to January 1, 2024 and before January 1, 2025, the initial BOI report must be filed within 90 days after the date that the secretary of state or other similar office provides notice that the Reporting Company has been created. This will most commonly be the date that the articles of incorporation, certificate of incorporation, articles of formation or other similar documents are file-stamped by a secretary of state as being formed.

For those Reporting Companies formed on or after January 1, 2025, the initial BOI report must be filed within 30 days after the date that the secretary of state or other similar office provides notice that the Reporting Company has been created.

Updates. The BOI reported to FinCEN must be kept up to date at all times. Any changes (even small changes) to the BOI must be updated by the Reporting Company within 30 days after the change occurred. The update requirements apply if an individual who is a beneficial owner of a Reporting Company dies, or a minor child becomes an adult.

Exempt Entities. If an exempt entity (such as a public company) no longer meets the requirement for an exemption from the CTA, then that entity must file a report within 30 days notifying FinCEN that it no longer meets an exemption and to report the BOI to FinCEN. Similarly, if a Reporting Company has filed its initial report with FinCEN and later qualifies for an exemption from the CTA, then that Reporting Company must also file a report with FinCEN to that effect within 30 days of qualifying for the exemption.

8. Penalties

Failure to comply with the CTA can lead to criminal and civil penalties. If an individual or Reporting Company willfully (voluntarily and intentionally) violates the CTA by either providing false beneficial ownership information, failing to report complete information or failing to update the beneficial ownership information, then they are subject to (1) a $500 per day civil penalty for each day the violation continues, and (2) may be fined not more than $10,000, imprisoned for up to two years, or both. There are additional penalties for any person who knowingly discloses the beneficial ownership information in a report submitted to FinCEN or who knowingly discloses information provided by FinCEN.

Concluding Comments

The CTA is an onerous and complex law that requires most privately-held companies to report information on themselves and on their beneficial owners and company applicants. You are urged to consult with your attorney to determine whether the CTA applies to your company and if so, the information that needs to be collected and submitted to FinCEN.

Resources:

FinCEN Beneficial Ownership Reporting Resource page:

https://www.fincen.gov/boi

Corporate Transparency Act (31 U.S. Code §5336):

https://www.law.cornell.edu/uscode/text/31/5336

Rule on Beneficial Ownership Information Reporting Requirements

https://www.federalregister.gov/documents/2022/09/30/2022-21020/beneficial-ownership-information-reporting-requirements

Proposed Rule on Collection of Beneficial Ownership Information:

https://www.federalregister.gov/documents/2023/01/17/2023-00703/agency-information-collection-activities-proposed-collection-comment-request-beneficial-ownership

Proposed Rule on FinCEN Identifiers:

https://www.federalregister.gov/documents/2023/01/17/2023-00708/agency-information-collection-activities-proposed-collection-comment-request-individual-fincen

LEGAL DISCLAIMER: ATTORNEY ADVERTISING

This article is considered advertising under applicable California law and may be considered advertising under other state's laws and ethical rules. This website and its contents are offered for informational, promotional purposes only and are not legal advice. Information in this article may be incorrect, incomplete or out of date. Please see the "DISCLAIMERS" page for additional disclaimers.