- LP Corner: Private Equity Fund Performance – An Overview

- LP Corner: Fund Performance Metrics – Multiples TVPI, DPI and RVPI - this blog post.

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part One

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part Two

- LP Corner: Fund Performance Metrics – Public Market Equivalent (PME)

- LP Corner: Fund Performance Metrics - Private Equity Fund Performance

- LP Corner: Gross vs Net Returns

In this post, we will explore using multiples as a tool to evaluate fund performance.

The multiples are:

- Distributions to Paid-in-Capital, or DPI

- Residual Value to Paid-in-Capital, or RVPI

- Total Value to Paid-in-Capital, or TVPI

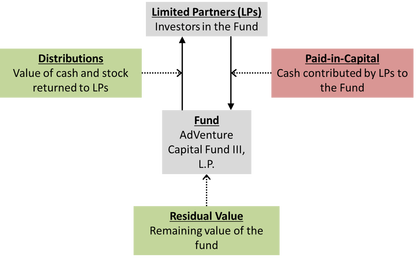

Here’s some important terminology that will help explain the multiples:

- Paid-in-Capital = the capital contributed by LPs to the fund. Paid-in-capital is also known as “contributed capital” or “called capital” or sometimes “drawn capital.” Note that Paid-in-Capital is different than Committed Capital. Recall that an investment in a private equity fund occurs over time. An investor in the fund, known as a limited partner or LP, agrees (commits) to invest a certain amount in a fund, say $10 million, as and when the manager of the fund, known as a general partner or GP, needs the capital. In this case, the $10 million is the LP’s commitment. As the GP asks for a portion of this commitment (known as a “call”), the amount paid by the LP to the fund is known as Paid-in-Capital, or PIC (this is also known as “called capital”).

- Distributions = the value of the cash and stock that the fund has given back (distributed) to the LPs. Distributions are typically low early in a fund’s life, ramping up over time as investments are exited.

- Residual Value = the remaining value of the fund at a given point in time. Residual value is the value of the fund’s investments plus other fund assets (cash, etc.) less fund liabilities. So, for example, if the fund has 12 remaining investments with an aggregate estimated fair value of $100 million and another $3 million in cash, the Residual Value of the Fund is $103 million. Early in a fund’s life when investments are being made residual value is typically high (reflecting the value of the investments) and declines over time as the fund exits its investments and makes distributions to the LPs.

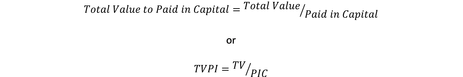

- Total Value = the total value of the fund, which is the sum of the distributions and the residual (remaining) value of the fund at a given point in time. The mathematical relationship among these metrics is:

To better understand the above terminology, let’s look at the terms graphically:

Start at the top of the graphic, with the LPs. The LPs invest (contribute) cash into the fund over time. The amount contributed by LPs in the fund through a particular date is known as Paid-in-Capital. The graphic shows PIC in red as it is a cash outflow for LPs. (For a discussion of committed capital vs paid-in-capital, please see my blog post “LP Corner: On Committed Capital, Called Capital and Uncalled Capital.”) The fund uses the Paid-in-Capital to invest in portfolio companies, and to pay management fee and fund expenses. As the fund exits its investments (the portfolio company is sold, is recapitalized or goes public) the fund will return cash and stock to the LPs. This return of cash and stock to LPs is known as Distributions. Distributions are shown in the graphic above in green, meaning they are cash inflows to LPs. The value remaining in the fund (primarily the value of the fund’s investments) is known as Residual Value. Residual Value is also shown in green in the above graphic, as over time this will become distributions to the LPs.

An Important Note: These are NET returns. In this discussion of multiples, we are discussing net multiples, meaning performance net of management fee, expenses and carried interest. Stated another way, these multiples are based on returns to the LP. Please see my prior post “LP Corner: Private Equity Fund Performance – An Overview” for a discussion of gross vs net returns.

Now, on to the multiples:

DPI (Distributions to Paid-in-Capital). Distributions to Paid-in-Capital is the ratio of Distributions to Paid-in-Capital, and that value is expressed as a multiple, such as 0.5, 1.2, 2.0, etc., but also expressed as 0.5x, 1.2x, 2.0x, etc. The DPI equation is as follows:

RVPI (Residual Value to Paid-in-Capital). Residual Value to Paid-in-Capital is the ratio of Residual Value (the remaining value of the fund) to Paid-in-Capital, which is also expressed as a multiple, such as 1.0 or 1.0x. The RVPI equation is as follows:

Pros and Cons of Using Multiples to Evaluate Fund Performance

Multiples are a common method used to evaluate the performance of a fund.

The main pros are:

- Multiples are widely used.

- Multiples are easy to calculate.

- Multiples don’t take into account the time value of money. So, for example, a 2x TVPI multiple may be a good result if the fund life is 7 years, but may not be a good result if the fund life is 15 years.

- Until the fund is liquidated, multiples are indications of interim performance. The final results for a fund won’t be known until the fund is liquidated – usually after year 12, but sometimes much later, and so it is important to remember that if the fund is still active, the performance multiples are interim, not final.

- Residual value is largely based on estimates of the value of the remaining portfolio investments. If Residual Value makes up most of Total Value (meaning there haven’t been many Distributions), then estimates of portfolio company investments drive the Total Value. The problem here is that Residual Value is subject to changing valuations as the companies mature. If the fund values an investment at $10 million at a particular point in time, but the company is sold and the fund only receives $2 million, then the Residual Value was overstated by $8 million. Conversely, if that investment is sold and the fund receives $20 million, then the Residual Value was understated by $10 million. Estimating values for portfolio company investments is more art than science, and so is subject to wide variability.

Simple Example

Let’s say that as of the end a particular quarter, a fund has called $50 million of capital (PIC = $50), has distributed $60 million to LPs (D = $60), and has a residual value of $70 million (RV = $70). Total value (TV) is calculated with the following equation: TV = RV + D, so Total Value here is $130 million ($70 RV + $60 D). With this information, we can calculate the multiples:

- TVPI is 2.6x ($130 TV / $50 PIC)

- DPI is 1.2x ($60 D / $50 PIC)

- RVPI is 1.4x ($70 RV / $50 PIC). This can also be calculated by using the formula TVPI = DPI + RVPI, so solving for RVPI = TVPI – DPI, which leads to RVPI = 1.4x (2.6 TVPI – 1.2x DPI).

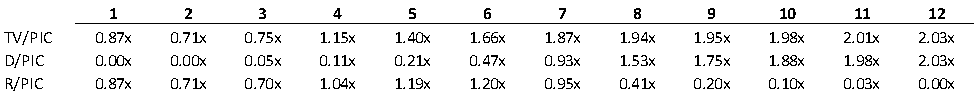

Detailed Example: AdVenture Capital Fund 3, L.P.

This is an early-stage venture capital fund that has committed capital of $100 million. Committed capital is the total amount of capital that LPs have agreed (committed) to provide to the fund over the life of the fund. In private equity, funds “call” capital over the life of the fund, with the bulk of the capital called during the investment term of the fund. This fund has a 10-year term, plus two 1-year extensions at the option of the general partner of the fund. The investment period for the fund is the first five years.

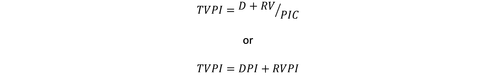

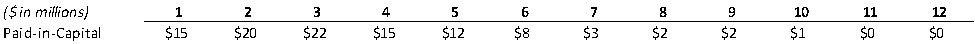

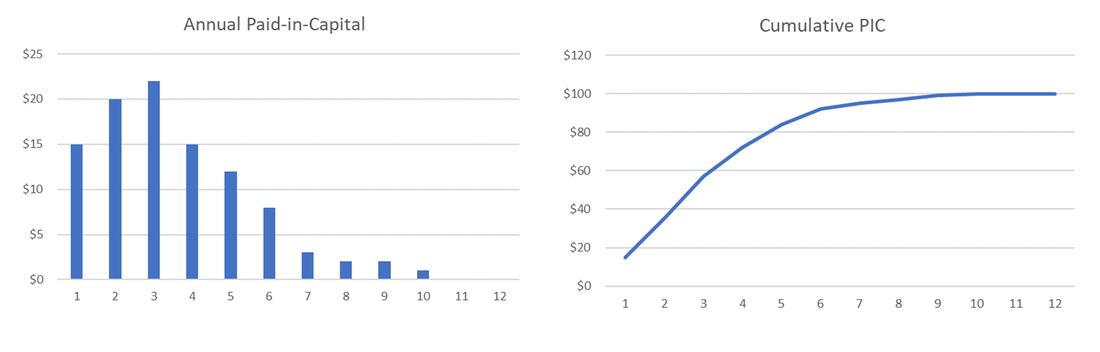

Paid-in-Capital (aka Called Capital)

Here’s what the capital calls look like over the 12-year life of the fund.

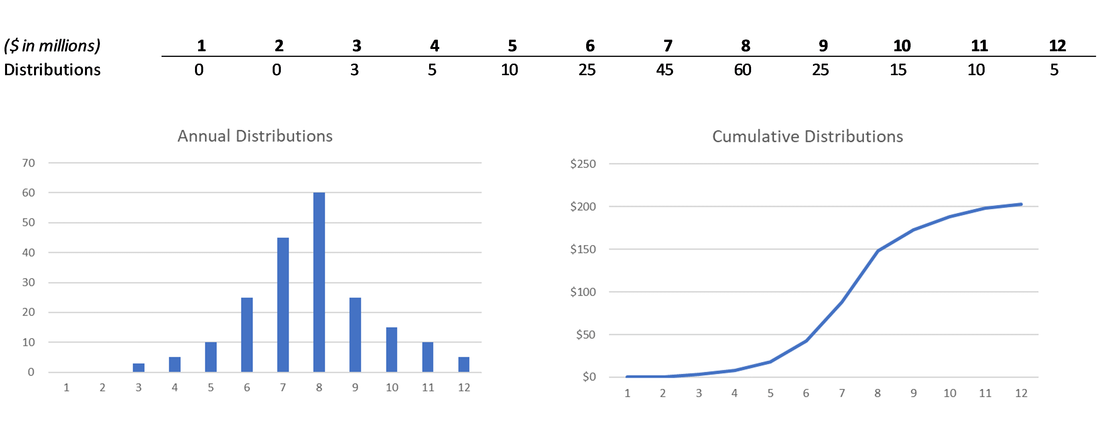

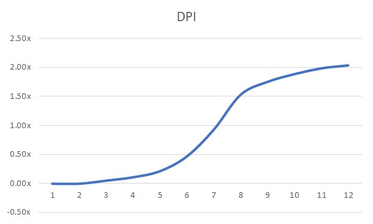

Distributions

Funds typically make distributions to the LPs after it has exited an investment or two. For this venture capital fund, once it makes an investment in a company, the fund will continue to hold that investment until the company is sold or goes public. This “holding period” is typically three to seven years, but can be as short as 6 months or as long as 15 years or more. This fund follows a more common path – no distributions for the first couple of years, and then a growing amount of distributions during the “harvest phase”, declining as the fund sells its remaining investments.

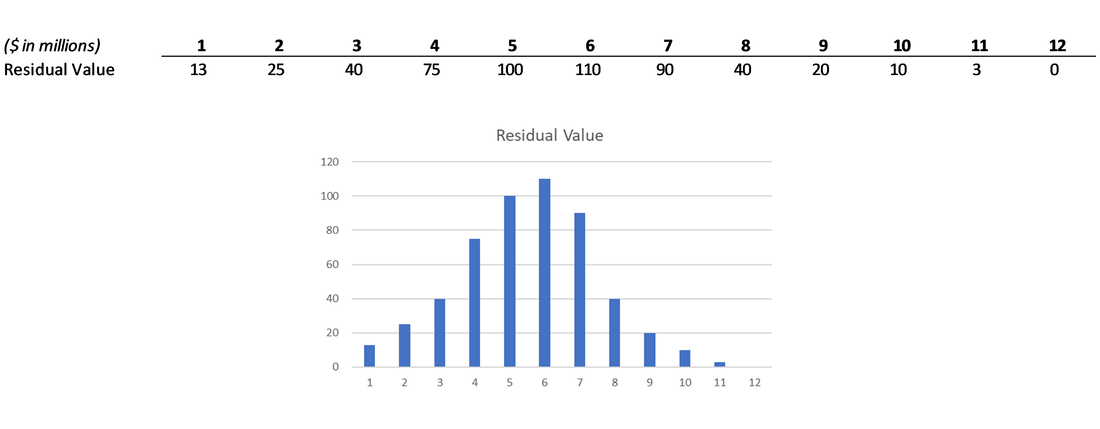

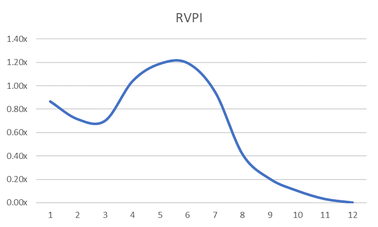

Residual Value

Residual value is the value of a fund at a given point in time. Residual value will change over time as the fund calls capital, the fund makes investments, investment valuations change, investments are exited and distributions are made to the LPs. Residual value is reported quarterly to LPs by the fund, and is called net asset value, or fund value in the financial statements.

For Adventure Capital Fund 3, L.P., the residual value at the end of each year is as follows:

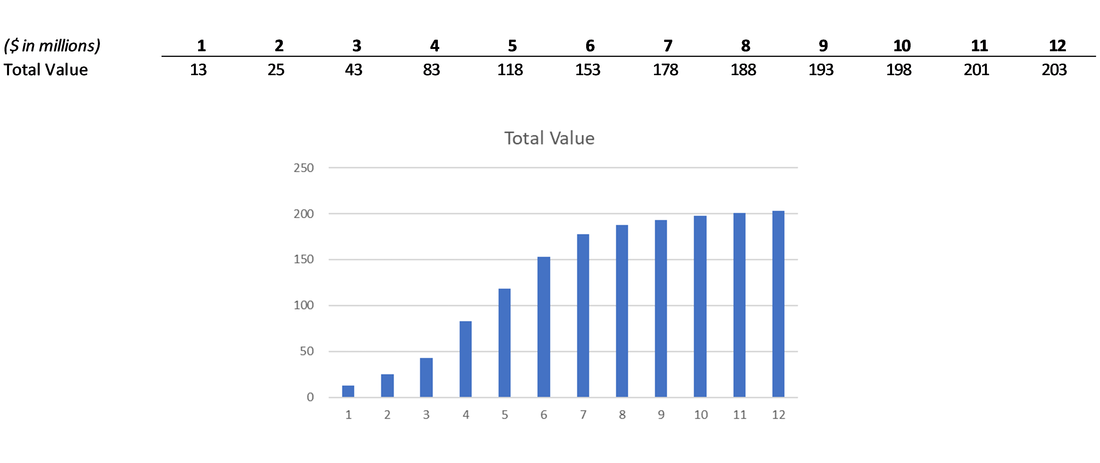

Total value is the fund’s total value at a given point in time, and is the sum of distributions and residual value. Recall Total Value = Distributions + Residual Value.

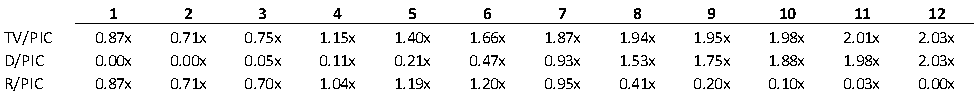

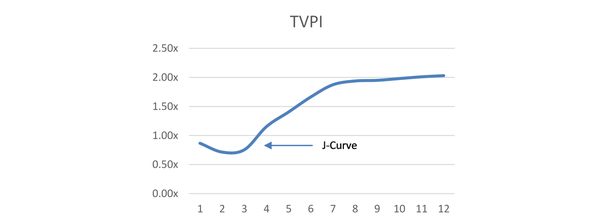

Now let’s calculate the multiples for this fund.

Now let’s look at DPI.

Finally, let’s take a look at Residual Value.

What all this means…

- Multiples will fluctuate over the life of a fund. The multiples in early years, especially for venture capital, will likely not be indicative of the final multiples. However, multiples after year 7 or 8 are more indicative of where the fund might end up. In other words, multiples don’t mean much in the first few years of an early-stage venture capital fund’s life.

- Interim vs final results. Until a fund is wound-up and fully liquidated, the performance multiples provide interim, not final, results. As a fund ages, the multiples tend to have less variability over time, but I’ve had fund hold on to investments for many years only to be sold for pennies on the dollar (compared to the valuation the fund was holding them at) late in a fund’s life.

- Residual Value is largely an estimate. Residual value is largely based on the estimated fair values of the underlying portfolio investments. These estimates may be high or low, but are rarely exact. Because of this, it is important to understand that the higher the Residual Value or RPI, the more variability the multiples may experience over time.

- Fundraising and multiples. Most funds start fundraising for their next fund every 2-3 years. If you are trying to evaluate an existing fund’s performance based on year 3 metrics, the multiples don’t necessarily tell you the whole story. You must really dig into the exits to date and the existing portfolio to really understand the potential of the fund.

Please help me improve this post by commenting. Thanks.

© 2018 Allen J. Latta. All rights reserved.