- LP Corner: Private Equity Fund Performance – An Overview

- LP Corner: Fund Performance Metrics – Multiples TVPI, DPI and RVPI

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part One

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part Two

- LP Corner: Fund Performance Metrics – Public Market Equivalent (PME) - This blog post.

- LP Corner: Fund Performance Metrics - Private Equity Fund Performance

- LP Corner: Gross vs Net Returns

We have now discussed two of the three primary metrics uses to evaluate the performance of private equity funds: (1) the multiples TVPI, DPI and RVPI; and (2) IRR. We will now explore the third primary metric: Public Market Equivalent, or PME.

Overview

Broadly speaking, PME is a return metric that compares the return of a private equity fund (or a portfolio of funds) to the hypothetical return of a chosen public stock market index, such as the S&P 500 or Nasdaq, using the cash flows as the fund as a basis for investment in the stock market index. For example, a fund may have an IRR of 15%, while the PME obtained using the S&P 500 as the index is 10%, suggesting that the fund has outperformed the S&P 500 by 500 basis points (bps).

There are several variations of PME, but these are commonly used:

- LN PME, developed by Austin Long and Craig Nickels in 1996

- PME+, developed by Capital Dynamics in 2003

- KS PME, developed by Steve Kaplan and Antoinette Schoar in 2005

- mPME, developed by Cambridge Associates and introduced in 2013

- Direct Alpha, developed by Oleg Gredil, Barry Griffiths and Rüdiger Stucke in 2014

LN PME

The LN PME (also known as the Index Comparison Method or ICM) is widely considered the “first” PME approach (and it is often referred to simply as “PME”). The LN PME matches each contribution and distribution of a fund with a hypothetical purchase and sale of a reference public market index, such as the S&P 500. The residual value of the fund is not matched to the LN PME; rather, the LN PME residual value is based on the performance of the hypothetical invested capital in the index. With these cash flows, an LN PME return for the public market index is compared directly against the IRR for the fund. If the fund’s IRR exceeds the LN PME, then the fund has outperformed the public market index. If the LN PME IRR exceeds the fund’s IRR, then the fund has underperformed the public market index. Note that the IRR generated using LN PME isn’t a “real” IRR – it’s an estimation because of the manipulation of the residual value.

One nice thing about the LN PME is that it is conceptually straightforward. However, the mechanics of LN PME have some issues. One issue for the LN PME approach is that the residual value for the PME index can be negative. This can occur if the fund has distributions early in the life of the fund, or has a series of large distributions late in the life of the fund. The problem is that a fund can’t have a negative residual value (technically a fund could have a negative residual value, but it would be a very rare case). As a result, LN PME isn’t used very often in private equity. The other forms of PME attempt to address the drawbacks of the LN PME.

Let’s look at an example:

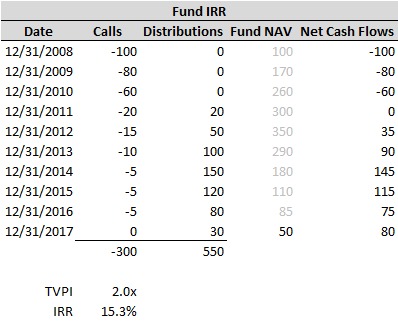

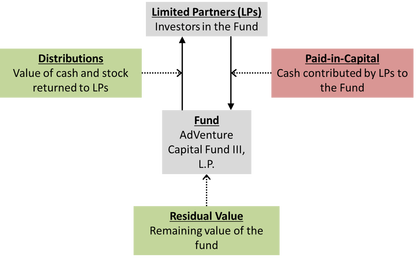

First consider the fund that we want to evaluate. The fund is presented below: