- Management Fee

- GP Commitment

- Carried Interest Overview

- Carried Interest – Preferred Return and GP Catchup

- Management Fee Offsets

- Key Person Clauses

- No Fault Divorce

- For Cause Actions

- Should Venture Capital Funds have a Preferred Return Hurdle?

In this post, we will explore what happens if the GP is paid too much carry. Generally speaking, the GP must return the overpayment, and this is called the GP clawback. But it’s not that simple, so read on!

How a GP Can be Paid Too Much Carry

In the prior post “LP Corner: Fund Terms – Carried Interest Overview” we discussed that there are two main types of carried interest – whole fund carry (also known as “European carry”) and deal-by-deal carry (also known as “American carry”).

In whole fund carry, the GP is paid carry only after the fund has returned to the LPs all of their contributed capital. This has the effect that the GP is paid carry later in the fund’s life (compared to deal-by-deal carry), and because the LPs are repaid all of their contributed capital before the GP takes its carry, it is pretty unlikely that the GP will receive too much carry.

Conversely, in deal-by-deal carry, the GP can collect carry much earlier than under whole fund carry, and in some cases, the GP can be paid too much carry over the life of the fund. Please review the example in the prior post for more detail on this and to see how too much carry can be paid.

To read more, please click on the "Read More" link below and to the right.

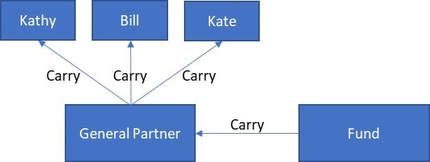

The diagram below shows how carry is paid. The fund pays carry to the General Partner, and the General Partner (usually a limited liability company, or “LLC”), distributes the carry to the individual members of the LLC. In this example, the individual members are Kathy, Bill and Kate. These three people comprise the team that will make the fund’s investments. As carry is earned, the fund distributes the carry to the GP, which in turn will pay the carry to each of Kathy, Bill and Kate. Because the GP is a flow-through entity for tax purposes, no tax is paid on the carry at the GP level and Kathy, Bill and Kate will each pay taxes on the amount of carry they receive. Note that Kathy, Bill and Kate may not each receive carry equally. For example, if Kathy and Bill are the senior members of the firm and Kate is an associate, Kathy and Bill may receive most of the carry and Kate a small portion of the carry. How carry is allocated among the investment team (and the firm) is often a sensitive topic.

GP Clawback

When a GP is paid too much carry, the concept is that the GP must pay the excess carry back to the fund. However, because the GP will have distributed the carry to its members, if excess carry must be repaid to the fund, each of the members (Kathy, Bill and Kate) will have to pay their share of the excess carry back to the GP and the GP will then pay the excess carry back to the fund.

Gross or Net of Tax?

As noted above, each of the members of the GP will have paid taxes on the carry they have received. The first question becomes how much of the excess carry should be repaid? Is it fair for the members of the GP to repay all of the excess carry when they paid tax on the carry and so only netted an after-tax amount? The answer is no. It is the custom in private equity that excess carry is paid on an “after-tax” amount. For example, in our example Kate received $400,000 in excess carry. Assume she paid $160,000 (40%) in taxes, so she netted $260,000 after tax. Kate would only be required to pay back to the GP $260,000. The fund agreement (the limited partnership agreement) will use an assumed tax rate, which is usually the highest tax rate, for determining the after-tax amount of excess carry that must be repaid to the fund.

Escrows and Interim Clawbacks

Life happens, even in private equity. During the course of a private equity fund’s 10-year term (which may end up being 15 years or more with extensions), a member of the GP may die. If the GP receives excess carry, distributes it to a member of the GP who later dies, how is that money recovered? For this and other reasons, a couple of mechanisms exist to minimize the risk of the fund not receiving back the excess carry.

The first mechanism is an escrow. In this case, an escrow account is established and a portion of each carry payment made to the GP is kept in this escrow account, which will be used to pay back the fund if there is excess carry. The second mechanism is to have interim clawbacks. Under interim clawbacks, the GP’s clawback liability will be calculated at an interim point or points in the fund’s life (such as after year 7), and if there is excess carry, it is paid back at that time. Escrows and interim clawbacks are useful tools to help mitigate the risks of the fund not receiving the clawback amount.