Venture capital investors in Facebook include Accel Partners, Andreessen Horowitz, Elevation Partners, Founders Fund, Greylock Partners, Kleiner Perkins Caufield & Byers, Meritech Capital Partners, Millennium Technology Value Partners and Technology Crossover Ventures.

|

The Wall Street Journal has an article discussing the Facebook IPO expected in the first half of 2012 and which bank, Goldman Sachs or Morgan Stanley, will win the coveted "lead" banker role. Good reading. Here's the link: http://online.wsj.com/article_email/SB10001424052970203686204577116823321665502-lMyQjAxMTAxMDIwOTEyNDkyWj.html

Venture capital investors in Facebook include Accel Partners, Andreessen Horowitz, Elevation Partners, Founders Fund, Greylock Partners, Kleiner Perkins Caufield & Byers, Meritech Capital Partners, Millennium Technology Value Partners and Technology Crossover Ventures.

0 Comments

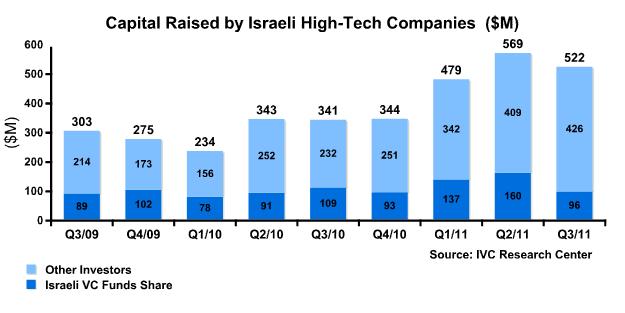

An article posted yesterday on Bloomberg.com "Google Backs Israeli Startups After Local Financing Hits 12-Year-Low: Tech" suggests that local Israeli financing is drying up. Here's a link to the article: http://www.bloomberg.com/news/2011-12-29/google-backs-israeli-startups-as-local-financing-hits-12-year-low-tech.html However, based upon information obtained from the source for the article, the Israel Venture Capital Research Center website (link: http://www.ivc-online.com/), the conclusion appears to be different. Here's a link to the release (.pdf): http://www.ivc-online.com/upload/archive/survey/IVC_Q3-11_Survey_PR-Eng-Final.pdf As the above chart indicates (from Israel Venture Capital Research Center website), through the first nine months of 2011, capital raised by Israeli high-tech companies totaled $1.57 billion $393 million, compared to $918 million in 2010, an increase of 71%. The amount raised from Israeli VC funds in the first nine months of 2011 was $393 million, compared to $278 million in the first nine months of 2010, an increase of 41%.

The Bloomberg article focuses on the percentage of total capital raised from Israeli VC firms, and points out that of the total capital raised in 3Q2011, 18% was from Israeli VC firms, and states that this is the lowest amount since IVC started covering the industry in 1999. While the proportion of funding may be low at 18%, the total amount of funding is increasing. In my view, the story should have included all of the information provided in the above chart, which suggests a different conclusion from that in the story. Businessweek.com recently featured an article "It's Always Sunny in Silicon Valley" that discusses some of the characteristics of the valley that lead to such an assessment. According to the article, reasons: a bias towards optimism, solid revenues by tech companies in the valley, strong initial public offerings by companies such as LinkedIn, Pandora Media and Zynga, the wealth created by these IPOs. The story is worth a read. Here's a link: http://www.businessweek.com/magazine/its-always-sunny-in-silicon-valley-12222011.html

Start-ups need a full team of engineers in place (or have the team identified) in order to attract venture capital funding, according to an interesting article on The Wall Street Journal's website. Solo entrepreneurs will have an especially difficult time in attracting financing. The need for a complete team comes as there is a shortage in engineers in Silicon Valley, according to the article. Here's the link: http://online.wsj.com/article_email/SB10001424052970204464404577114571891032732-lMyQjAxMTAxMDIwOTEyNDkyWj.html

Mark Suster, a General Partner at GRP Partners, has recently posted a good "intro" article on his blog Both Sides of the Table that discusses the relationship of growth and profitability. This is a good intro article for entrepreneurs looking to obtain VC funding or a good refresher article. Here's the link: http://www.bothsidesofthetable.com/2011/12/27/should-startups-focus-on-profitability-or-not/

TechCrunch has a good post on Zhongguancun, outside of Beijing, which is a technology hub in China. Here's the link: http://techcrunch.com/2011/12/27/geeks-guide-china-silicon-valley/

"Big Data" generally refers the massive amount of data that is being generated today. The vast amount of this data, the speed at which it is being generated and the variety of sources of the data make it difficult for traditional data analytic software tools to capture and analyze it. Many venture-backed start-ups are tackling this problem, and a recent column on the NYTimes.com website discusses this. Here's the link: http://www.nytimes.com/2011/12/26/technology/for-start-ups-sorting-the-data-cloud-is-the-next-big-thing.html?_r=1&pagewanted=all

GoGo Wireless, the in-flight wifi provider, filed for its initial public offering today. Investors in GoGo include private equity firm Ripplewood Holdings.

SEC S-1 filing: http://www.sec.gov/Archives/edgar/data/1537054/000119312511351260/d267959ds1.htm Interesting article posted a while back from Matt Krantz of USAToday.com about what the first day of trading for an IPO tells investors. Here's the link: http://www.usatoday.com/money/perfi/columnist/krantz/story/2011-10-05/ipos-first-trading-day/50674710/1

2011 was a bad year for IPOs, according to an article in USA Today. Here's the link: http://www.usatoday.com/money/perfi/stocks/story/2011-12-22/bad-year-for-ipos/52170080/1

While I agree that 2011 didn't live up to expectations, it could have been worse. I'm hopeful that 2012 will be a better year for the global economy, the stock markets and IPOs. Happy Holidays! TripAdvisor, the world's largest internet travel site, was spun out of Expedia today as a separate company trading on Nasdaq (ticker: TRIP). Expedia shareholders received one share of TripAdvisor and one share of Expedia for every two shares of Expedia they owned as of the close of trading on Tuesday. Expedia shares traded as high as $30.00 per share today, but are trading at below $29.00 as of 3:00 pm NY time.

Links to articles: AP (Yahoo! Finance): http://finance.yahoo.com/news/Expedia-completes-TripAdvisor-apf-1610599645.html?x=0 Seeking Alpha: http://seekingalpha.com/article/315336-tripadvisor-spins-off-from-expedia-takes-flight-as-a-public-company?source=yahoo Many bulge-bracket investment banks offer private wealth clients the opportunity to invest in funds managed by a bank that in turn invest in hot private companies (such as Groupon and Zynga) prior to the initial public offering. Andrew Ross Sorkin recently posted an article on NY Times DealBook that discusses how investment banks can profit from these types of investments. Essentially, through these bank-managed fund investments, the banks already have an investor relationship with the company, which may help secure a lead manager role in the company's IPO. Interesting article worth a read. Here's the link: http://dealbook.nytimes.com/2011/12/19/two-ways-for-banks-to-win/ First Round Capital has posted a holiday video that parodies Rebecca Black's Friday video. Creative and worth a watch. Here's the link: http://www.youtube.com/watch?v=HP4HiZt3DFE&feature=channel_video_title

NY Times DealBook reports today that Zynga's investment bankers made $32.5 million from Zynga's initial public offering, citing data from Standard & Poors. Not bad for a few months of work. Here's a link to the story: http://dealbook.nytimes.com/2011/12/19/zyngas-bankers-reap-fees-as-stock-slides/

Update 12/20/2011: Fortune reports that the investment was actually a secondary transaction of shares from Twitter investors. Here's the link: http://finance.fortune.cnn.com/2011/12/19/saudi-prince-deal-for-twitter-is-a-secondary/

Original Post: Prince Alwaleed bin Talal and his investment company Kingdom Holding Company have made a combined Investment of $300 million in Twitter, it was announced today. This is being characterized as a strategic investment in Twitter, but the valuation (or percent ownership in Twitter) wasn't disclosed. Prince Alwaleed is a nephew of the Saudi King. Twitter's venture capital investors include Andreessen Horowitz, Benchmark Capital, Charles River Ventures, Insight Venture Partners, Institutional Venture Partners, Kleiner Perkins Caufield & Byers, Spark Capital and Union Square Ventures. Links: Link the the Kingdom Holding Company press release: http://www.prnewswire.com/news-releases/prince-alwaleed--kingdom-holding-company-make-a-300-million-investment-in-twitter-135843108.html Links to stories: AP: http://www.google.com/hostednews/ap/article/ALeqM5h3Nk_HUGilGKjSdSBe0wlqNeUdYg?docId=ed903df8db814df7b2f227cc983835d9 NY Times DealBook: http://dealbook.nytimes.com/2011/12/19/saudi-prince-invests-300-million-in-twitter/ Business Insider has posted a presentation by Bill Gross, serial entrepreneur and founder of idealab, that Bill gave recently at the LeWeb conference in Paris. The presentation is entitled: "Learning from Failure*" with the footnote "* 12 lessons from my life as an entrepreneur." I found this to be a fascinating presentation and recommend it to entrepreneurs. Here's the link: http://www.businessinsider.com/bill-gross-lessons-2011-12?op=1

Zynga priced its IPO at $10 per share, started trading at $11 per share, but closed below its IPO price at $9.50 on its first day of trading. Why did Zynga break its IPO price? Based upon various reports, there are several reasons why this might have happened:

Valuation / Offering Size and Price. Some reports have indicated that Zynga's IPO valuation, at a $7 billion market capitalization, is too high. While this valuation was lower than some estimates, perhaps the market felt that this was still too high. Other reports felt that Zynga should have sold less shares in its IPO (it sold 100 million shares), raising less money, but creating a supply-demand imbalance that would have driven the stock price up on the first day. Zynga sold 14% of its outstanding shares in its IPO, which is a smaller amount than the usual 20% to 30% that is sold in an IPO. Some felt that if Zynga sold only 10% of the company in the IPO, the stock price would have shot up. I'm skeptical of the long-term effects of this type of "low-float IPO" strategy, as it is retail investors that drive the stock price up in these offerings, and once the retail exuberance wears off, the stock price can come crashing down. Business Model Concerns. While Zynga is profitable, one report suggests that recent profitability may have come from accounting changes and that the company may only have been near breakeven otherwise. In addition, Zynga obtains the vast majority of its revenue from Facebook, and hasn't to date developed its revenue-generating business significantly beyond the Facebook platform. Finally, Zynga profits from only 3 percent of its players that purchase virtual game pieces, and the growth rate of bookings is slowing. Stock/Voting Structure. Zynga has a three tier stock structure, where Marc Pincus has 70 votes for every one share he owns, other insiders have seven votes for every one share they own, and public stockholders have one vote per share they own. This translates to Mark Pincus and other insiders having voting control over the company. The argument for insiders having this much voting control is to allow management to focus on long-term shareholder value and not be worried about short term stock price swings. The argument against it is that the management may not be able to handle the growth and would need to be replaced, which would be impossible to do if they control the company. Market Factors / Market View of Social Gaming. Some reports suggest that given the volatility in the markets, investors are becoming more wary of social gaming. Sources: Reuters: http://www.reuters.com/article/2011/12/16/zynga-idUSL1E7NGPQ20111216 VentureBeat: http://venturebeat.com/2011/12/17/why-did-zyngas-stock-tank-on-day-one-analyst-cites-red-flags/ NY Times DealBook: http://dealbook.nytimes.com/2011/12/16/zyngas-modest-debut/ Wall Street Journal: http://online.wsj.com/article/SB10001424052970204466004577102371445084982.html?mod=googlenews_wsj 24/7 Wall St.: http://247wallst.com/2011/12/15/zynga-ipo-prices-great-offering-lousy-voting-rights-znga/ Zynga, which prices its initial public offering last night at $10.00 per share, is now trading at around $9.50 per share. The stock price opened at $11.00 and peaked at $11.08 before falling below the $10.00 IPO price.

Zynga sold 100 million shares at $10.00 per share, for a $1 billion IPO. Venture Capital investors include Kleiner Perkins Caufield & Byers, Institutional Venture Partners, Foundry Group, Avalon Ventures and Union Square Ventures. Zynga has prices its initial public offering at $10.00 per share, at the top of the $8.50 to $10.00 range, according to reports. The company's shares are set to begin trading tomorrow morning Zynga sold 100 million shares in the IPO, raising $100 million. Venture Capital investors include Kleiner Perkins Caufield & Byers, Institutional Venture Partners, Foundry Group, Avalon Ventures and Union Square Ventures.

Here's a link to a story at WSJ.com (firewall): http://online.wsj.com/article/SB10001424052970203893404577099293401936570.html?mod=WSJ_hp_LEFTTopStories The National Venture Capital Association (NVCA) and Dow Jones VentureSource have released their survey of venture capital predictions for 2012. The report can be found at the NVCA's website. In the press release, the NVCA indicates that forecasts from venture capitalists and CEOs of venture-backed companies are "less confident and more measured for the coming year." Investments in the information technology sector are expected to rise in 2012, while investments in the biopharmaceutical, medical devices and cleantech sectors are predicted to decline.

There is also a sheet of predictions from venture capitalists. Check it out as there are some good quotes. One take-away is that there is an expectation of continued contraction for the venture capital industry. Link to the NVCA website: www.nvca.org A recent post to SeekingAlpha by Mazen Abdallah entitled "Beware Insider Selling in 'Small Float' IPOs" explores the impact of lockup expirations on the stock price of "small float" IPOs. Typically, roughly 20% to 30% (in my experience) of the company's shares are sold in an IPO. In a "small float" IPO, the amount of shares sold in an IPO is reduced (often between 10-15% in my experience) to create a supply-demand imbalance of too few shares and too much demand, typically resulting in a big first-day price increase. Mr. Abdallah explores what happens to these "small float" IPOs 180 days later when certain insider trading restrictions lapse and a large amount of shares becomes eligible for sale, reversing the supply-demand imbalance to too many shares and too little demand. Interesting reading.

Here's the link: http://seekingalpha.com/article/313611-beware-insider-selling-in-small-float-ipos Jive Software Inc. has priced its initial public offering at $12 per share, above the filing range of $8 to $10 per share, selling 13,439,600 shares and raising over $161 million in the IPO. The IPO gives the company an implied market capitalization of over $700 million.

The company's common stock will begin trading tomorrow on NASDAQ under the symbol JIVE. The company sold 10,072,463 shares and selling stockholders sold 3,367,137 shares in the offering. This was an increase of nearly 2 million shares than was indicated in their prior S-1/A filing. The lead underwriters were Morgan Stanley and Goldman Sachs. Venture capital investors in Jive Software include Sequoia Capital and Kleiner Perkins Caufield & Byers. Jive is an enterprise social networking company that enables companies to communicate and collaborate with its employees, customers and partners. Links: Jive Software press release: http://www.jivesoftware.com/news/releases/2011/12/jive-software-announces-pricing-of-initial-public-offering Wall Street Journal article: http://online.wsj.com/article/BT-CO-20111212-714832.html Forbes: http://www.forbes.com/sites/tomiogeron/2011/12/12/jive-software-prices-ipo-at-12-per-share/ The Los Angeles technology / venture capital scene is a bit quieter than its northern neighbor in Silicon Valley. This LA Times article indicates that efforts are underway to bring LA more to the forefront of entrepreneurs, engineers and venture capitalists. Here's the link: http://www.latimes.com/business/la-fi-cover-la-tech-20111211,0,7901017.story

Zynga's IPO is on track to price next week, according to reports. Some are predicting a huge first day pop for the IPO price. Zynga is offering 14% of the company in its IPO (see my prior post on 12/2/2011), which is a relatively small amount, and could result in a first day supply/demand imbalance and a price increase.

Venture Capital investors include Kleiner Perkins Caufield & Byers, Institutional Venture Partners, Foundry Group, Avalon Ventures and Union Square Ventures. Links: Bloomberg: http://www.bloomberg.com/news/2011-12-08/zynga-said-to-receive-enough-orders-to-cover-all-100-million-shares-in-ipo.html Seeking Alpha: http://seekingalpha.com/article/312763-zynga-ready-to-skyrocket-out-of-the-gate MarketWatch: http://www.marketwatch.com/story/zynga-jive-software-to-head-big-ipo-week-2011-12-08?link=MW_latest_news LivingSocial, the number two daily deals website behind Groupon, is reportedly raising a $400 million private funding round at a valuation of $6 billion. Venture capital investors include Grotech Ventures, Institutional Venture Partners, Lightspeed Venture Partners, Steve Case's Revolution LLC, and US Venture Partners. Amazon.com is also an investor.

Links to stories: WSJ.com (subscription firewall): http://online.wsj.com/article/SB10001424052970203413304577084803856892004.html?KEYWORDS=STU+WOO Bloomberg: http://www.bloomberg.com/news/2011-12-07/livingsocial-said-to-receive-funding-valuing-coupon-website-at-6-billion.html |

About this Blog

This Blog is a collection of thoughts on a variety of topics of interest to me, including: Categories

All

Archives

January 2024

Copyright Notice:

All original works on this site are © Allen J. Latta. All rights reserved. Neither this website nor any portion thereof may be reproduced or used in any manner whatsoever without the express prior written permission of Allen J. Latta. LP Corner® is a registered trademark of Campton Private Equity Advisors. Used with permission. DISCLAIMER: Readers of this Blog are not to construe it as investment, legal, accounting or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Readers should consult with their own investment, legal, accounting, tax and other advisors to the determine the benefits and risks of any investment.

Private equity investments involve significant risks, including the loss of the entire investment. This Blog does not constitute an offer to sell or the solicitation of an offer to buy any security. |