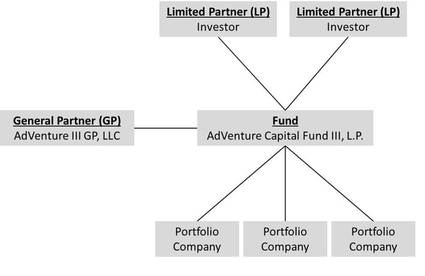

Basic Limited Partnership Structure

In a basic limited partnership, there are several passive investors (known as "Limited Partners" or "LPs") and the manager of the fund, (known as the "General Partner" or "GP"). The diagram below illustrates this basic structure.

Why is the limited partnership used? There are a few key reasons why limited partnerships are used for private equity funds.

- Tax pass-through entity. A limited partnership is treated as a "partnership" for federal tax purposes. The main benefit of this is that there is only one level of tax, at the investor level. Compare this to a C-corporation, where the federal government imposes taxes at the corporate level and at the shareholder level when the shareholder receives dividends.

- Limited liability for limited partners (investors). So long as a limited partner is not actively involved in the management of the fund, the limited partner has limited liability. This means that the most that a limited partner can lose is the total amount of its investment in the fund.

- GP control. A feature of limited partnerships is that the General Partner controls the fund, and has no investor oversight. In a corporation, the shareholders elect a board of directors, which has the power to hire and fire the management of the company. Nothing like a board of directors with power over management exists in a limited partnership structure.

- LP Advisory Committee. Most private equity funds do have an "advisory committee" which is composed of limited partners chosen by the GP to advise (not direct) the GP on matters such as valuations and conflicts of interest. These Limited Partner Advisory Committees (or "LPACs" as they are known) are advisory only - the GP has final say over matters relating to the fund. Note too that LPs on the LPAC cannot have management authority over the GP without jeopardizing their limited liability status as passive limited partners.

- Historical. The limited partnership structure has been around for a long time and has been used in the private equity industry for decades. There is a newer type of corporate vehicle called the limited liability company ("LLC") which been gaining traction as it is even more flexible than a limited partnership. Many GPs and private equity firms are structured as LLCs.

GP Unlimited Liability. One feature of limited partnerships is that the General Partner of the fund has unlimited liability for the debts and obligations of the fund. Recall that Limited Partners have limited liability for liabilities of the fund (so long as they are not actively involved int he management of the fund). If an individual acts as the GP, the individual has unlimited liability for the liabilities of the fund. Few individuals are willing to assume this unlimited liability, and so GPs are themselves organized as limited liability entities, commonly an LLC. While the LLC-GP has unlimited liability for the liabilities of the fund, the individual owners of the LLC have limited liability. Confusing? Sure, but keep in mind that protecting against liabilities is a key focus of any investment manager, and so multiple layers of entities are often used to protect the principals from unlimited liability.

Delaware. Another feature of US private equity limited partnerships is that the vast majority of these entities are organized in Delaware. Why Delaware? A couple of reasons. First is that Delaware is pro-management - this means that Delaware law in many instances favors the GP over LPs. Good for the GP, not so good for LPs. Second, Delaware has a very well-established body of law relating to limited partnerships, and so the certainty of the legal environment also helps.

Fund Term. Most private equity limited partnerships have a defined term - commonly 10 years, and typically have extension periods of one year each, at the discretion of the GP. Most private equity funds are specifically designed to wind-down and terminate over a period of time.

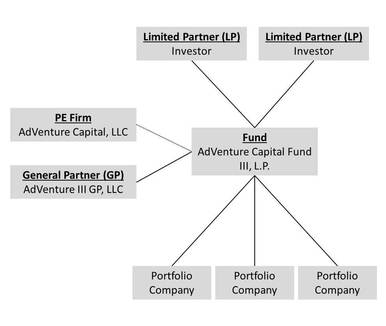

Advanced Limited Partnership Structure

Funds pay a management fee and profit share (known as "carried interest" or "carry") to the GP for the management of the fund. For several reasons, the management of the fund is usually contracted to an affiliated private equity firm (called the "PE Firm" for purposes of this post). The carried interest typically stays with the GP, but is allocated among the individual owners of the GP. In this way, the individuals who are actively investing the fund will receive the carried interest. GPs are also specific to a fund - once the fund winds down and terminates, so does the GP.

The PE Firm is a separate entity that provides management and investment services to the fund (and to subsequent and affiliated funds). Think of the PE Firm as a permanent entity that rents the office space, employs the investment professionals and staff, and provides investment and management services to its funds. The PE Firm is initially owned by the individuals who founded the firm. Also note that the ownership of the PE Firm and the GP may differ, and typically does over several funds as the PE Firm brings on new investment professionals.

Below is an illustration of the fund with the PE Firm shown.

Comments?