- LP Corner: Private Equity Fund Performance – An Overview

- LP Corner: Fund Performance Metrics – Multiples TVPI, DPI and RVPI

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part One

- LP Corner: Fund Performance Metrics – Internal Rate of Return (IRR) – Part Two

- LP Corner: Fund Performance Metrics – Public Market Equivalent (PME)

- LP Corner: Fund Performance Metrics - Private Equity Fund Performance

- LP Corner: Gross vs Net Returns - this blog post

We have discussed how to evaluate fund performance, but a common area of confusion is gross returns versus net returns. I briefly introduced this topic in LP Corner: Private Equity Fund Performance - An Overview, and this post expands on that introduction.

When talking returns in private equity, it is very important to know what kind of returns you are discussing: gross or net returns. The difference between these two metrics can be meaningful, and so it is important to know what is being discussed. Gross returns, simply stated, are the returns a fund obtains from its investments, without deducting any management fees, fund expenses or carried interest. Net returns are the returns a limited partner (LP) receives from the fund, after deduction of all management fees, fund expenses and carried interest. LPs are about net returns, as net returns are the real returns an LP receives from its investment in a fund.

When we talk about gross vs net returns, it can apply to gross vs net IRRs or gross vs net TVPI multiple.

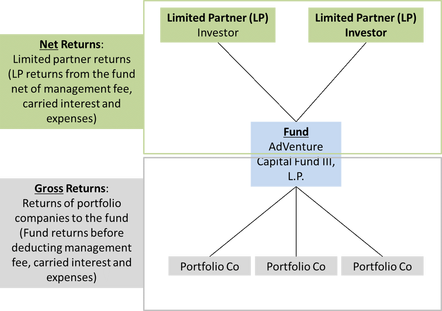

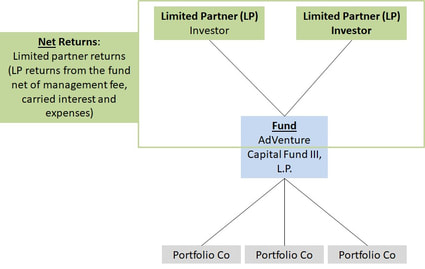

The graphic below shows the difference between gross and net returns for a fund. LPs invest in a fund. The fund invests in portfolio companies. Gross Returns are the returns the fund obtains from its investments in portfolio companies. Gross Returns are before deducting management fee, fund expenses and carried interest. Once the fund does deduct the management fee, fund expenses and carried interest, the return the LPs obtain from the fund are the Net Returns.

Let’s look at at the following examplel to illustrate this.

Example:

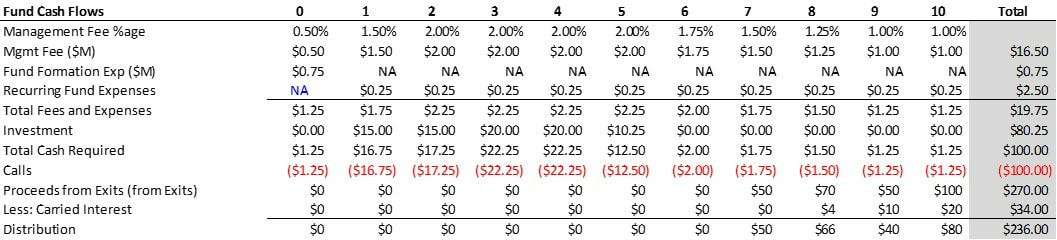

AdVenture Capital Fund III, L.P. (“Fund 3”) is a $100 million venture capital fund. It charges a 2% per annum management fee during the five-year investment period, and then the management fee declines by 25 bps (25 basis points equals 0.25%) each year with a minimum management fee of 1% per year. Fund 3 has a 20% European carry (carry is paid only after LPs have received distributions equal to their paid-in-capital). Fund 3 has $750,000 in fund formation expenses and $250,000 in annual fund expenses (insurance, audit, back office, legal, travel, etc.). We also assume a 10-year fund and no recycling.

Gross Returns:

First, we’ll calculate the gross returns. Looking at the diagram, we see that the gross returns involve the fund and its portfolio company investments.

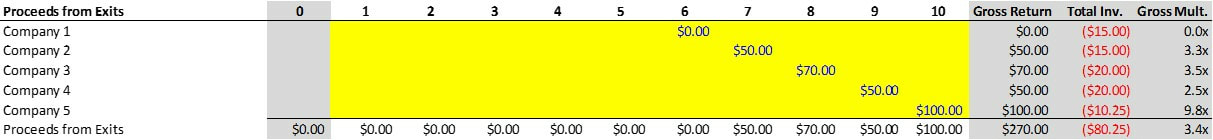

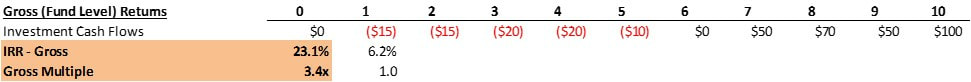

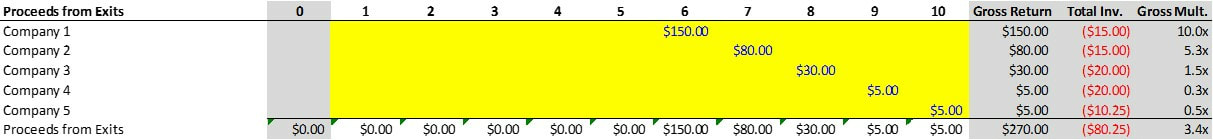

Assume Fund 3 makes one investment per year, for a total of five investments (this is a simplified example, as most funds invest in more than five companies), as shown in the table below. Note that investments are negative numbers here as they are cash outflows from the fund. The "0" column represents the fund's initial capital call, when the IRR clock starts to run. The "1" column is year 1, "2" is year 2, etc.

As the above table indicates, the first investment of $15 million in year 1 was a write-off (gross multiple of zero), the second investment of $15 million in year 2 returned $50 million in year 7 (for a gross multiple on investment of 3.3x), the third investment of $20 million in year 3 returned $70 million in year 8 (for a gross investment of 3.5x), and so on. Overall, Fund 3’s investments returned a total of $270 million on total investment of $79.5 million, for a gross return of 3.4x. This is gross return – the return the fund has on its investments.

When the cash flows of the fund’s investments and the exit values are combined, the gross IRR can be calculated.

Net Returns:

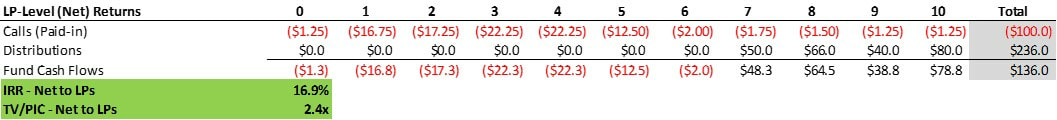

Now let’s look at the net returns to the LP. Net returns to the LP are based on the LPs cash flows. The LP makes contributions to the fund and receives distributions from the fund. Net returns to the LP are at the LP level, after management fee, carried interest and fund expenses have been deducted. Looking at the diagram below, we are looking at the green shaded boxes.

When the cash flows (calls made by the LPs and distributions received by the LPs) are modeled, the net IRR can be calculated.

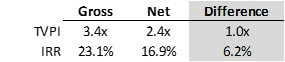

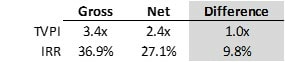

The gross and net results are summarized in the table below

Now let's look at another example.

Example 2:

Let’s use the same assumptions as in example 1 above, including the total proceeds from exits, except the exit values will change.

The result? Gross TVPI of 3.4x and net TVPI of 2.4x. Gross IRR of 36.9% and net IRR of 27.1%. The results are in the table below.

Recall my rule of thumb: Deduct 1.0x from Gross TVPI to obtain Net TVPI, and deduct 10% from gross IRR to obtain net IRR. In this example, the rule of thumb is spot on, but most of the time the rule of thumb overstates the differential.

Rule of Thumb Data. I have a small data set of funds that have provided gross and net returns. In my data set, the the range of differential for gross to net TVPI is from 0.1x to 1.4x and the range of differential for gross to net IRR is 3.9% to 12.6%. This data suggests that the rule of thumb should be to deduct .6x from gross TVPI to obtain net TVPI and to deduct 8% from gross IRR to get net IRR. However, because the ranges are so wide, I will still go with my rule of thumb until I get better information from the fund.

In his article "A Note on Direct Investing in Private Equity" in the Alternative Investment Analyst Review (1Q 2016), Prof. Ludovic Phalippou of the Said Business School at the University of Oxford discusses buyout fund fees and indicates that the average gross returns are 18% and net returns are 11%, for a differential of 7%. This 7% is more in line with the findings from my small fund data set. Prof. Phalippou's insightful note can be found at https://caia.org/aiar/access/article-919.

Take-aways:

- Gross returns are always higher than net Returns. The only time they can be equal to each other is if the fund has no management fee, no carry and no expenses!

- My rule of thumb is to deduct 1.0x from gross TVPI to obtain net TVPI, and deduct 10% from gross IRR to obtain a net IRR. This rule of thumb typically overstates the differential between gross and net returns, but until better information is obtained from the GP, it can provide an initial basis for comparison.

Request to the reader: Please help me improve this post. Please contact me with any suggestions on how to make this better, clarifications and typos. Thanks!

Also, thanks to Mark for finding an error in the spreadsheet in a prior version of this post. The error has been fixed.

© 2018 Allen J. Latta. All rights reserved.