https://partnerconnectevents.com/emcwest2018/index.php

|

I am pleased to be a speaker at the upcoming Emerging Manager Connect West conference being held on Tuesday, May 1, 2018 at the Marines Memorial Club in San Francisco . I will be speaking on the panel "Roadshow 101: Leading Emerging Manager Investors Discuss the Dos and Dont's for Successful LP Meetings." Here's a link to the conference website:

https://partnerconnectevents.com/emcwest2018/index.php

0 Comments

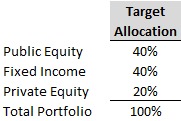

The denominator effect refers to an investor's private equity portfolio value exceeding its target allocation due to the decline in value of other elements in the investor's overall investment portfolio. Conversely, the “reverse denominator effect” refers to private equity value falling below its target allocation due to the increase in value of other elements in the portfolio. In order to understand Denominator Effect and the Reverse Denominator Effect, this post will first review basic portfolio allocation and rebalancing, and then will briefly review fractions. Portfolio Allocations and Rebalancing Most investors will develop a portfolio investment strategy by allocating a portion of the portfolio to different investment classes (called “asset classes”) such as public equities (stocks), fixed income securities (bonds), real estate, cash and private equity. Investors may define asset classes differently and may allocate their portfolio across asset classes differently. Let’s say an investor has $1 billion to invest. After working with their investment advisor, they have decided to create target allocations for their portfolio as follows: 40% to public equities, 40% to fixed income and 20% to private equity. (We’re keeping it simple here; most investors will allocate to more than 3 asset classes). These are target allocations – the actual values may vary from the target value. The target allocation will look like this: To read more, please click on "Read More" link below.

|

About this Blog

This Blog is a collection of thoughts on a variety of topics of interest to me, including: Categories

All

Archives

January 2024

Copyright Notice:

All original works on this site are © Allen J. Latta. All rights reserved. Neither this website nor any portion thereof may be reproduced or used in any manner whatsoever without the express prior written permission of Allen J. Latta. LP Corner® is a registered trademark of Campton Private Equity Advisors. Used with permission. DISCLAIMER: Readers of this Blog are not to construe it as investment, legal, accounting or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Readers should consult with their own investment, legal, accounting, tax and other advisors to the determine the benefits and risks of any investment.

Private equity investments involve significant risks, including the loss of the entire investment. This Blog does not constitute an offer to sell or the solicitation of an offer to buy any security. |