- Management Fee

- GP Commitment

- Carried Interest Overview

- GP Clawback

- Management Fee Offsets

- Key Person Clauses

- No Fault Divorce

- For Cause Actions

- Should Venture Capital Funds have a Preferred Return Hurdle?

In this post, we will explore two items relating to carried interest: preferred return and GP catchup.

Preferred Return Hurdle

A preferred return (or “hurdle rate”) is a minimum threshold return that LPs must receive before the GP can receive its carried interest (or “carry”). The preferred return is usually expressed as a percentage return per year, and in private equity that is usually 8% per year. This means that the LPs must receive an 8% annual return on their contributed capital before the GP can receive carry.

GP Catchup

There are two types of preferred return hurdles: (1) a “pure preferred return” (also known as “hard preferred return”); and (2) a preferred return with GP catchup.

Pure Preferred Return Hurdle. In the pure preferred return hurdle, the GP only receives carry on gain in excess of the preferred return hurdle. This has the impact of reducing the carry the GP receives over the life of the fund. The pure preferred return hurdle is not used in private equity.

Preferred Return with GP Catchup. In a preferred return with GP catchup, once the preferred return hurdle is met, the GP receives all or most of the future profits until the GP catches up to its 20% carry amount, and after that the profits are split 80% to the LPs and 20% to the GP (for its normal carry). The preferred return with GP catchup results in the GP receiving its entire 20% profit share. This version of preferred return hurdle is the norm in the private equity industry.

To read more, please click on the "Read More" link below and to the right.

Why does the preferred return hurdle exist? In my view, there are two reasons. First, investors in private equity funds have return expectations of 15% or more (higher for venture capital), and the preferred return allows LPs to achieve this “minimum return” before the GP can take any profit participation (carry). This aligns the interests of the GP with the LPs – LPs must earn a minimum return before the GP can take carry. The second reason is that by having a preferred return hurdle as an annual percentage rate injects the time value of money into the carry calculation. If carry was only calculated on money-on-money returns, the GP might be incentivized later in a fund’s life to let marginally-performing portfolio companies to stay on the fund’s balance sheet in case the company’s performance later improves or the company is acquired. As most LPs use an annualized return metric as part of their portfolio performance evaluation, including an annualized preferred return hurdle better aligns GP and LP interests.

Which Funds Have Preferred Return Hurdles?

Virtually all buyout funds and many growth equity funds have an 8% per annum preferred return hurdle. Venture capital funds often don’t have a preferred return hurdle. I’ve heard from venture capitalists that that the reason why venture funds don’t have preferred return hurdles is that early-stage venture investments take so long to exit that adding a preferred return hurdle would push back by years the time when venture capital fund managers could earn carry. I am of the view that venture capital funds should also have an annualized preferred return hurdle.

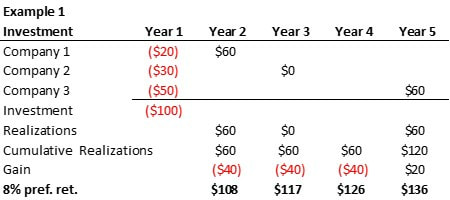

Example 1. Carry computations are complex. Because of this, we will use a highly simplified example to illustrate how a preferred return works. Assume our fund has $100 million of committed capital, no management fee or expenses, 20% carry on a whole-fund basis, and a 5-year life. Also assume that all $100 million is called in year 1 (put another way, in year 1 the LPs have contributed all of the $100 million commitment to the fund). The fund invested all of the $100 million in year 1 into 3 companies. The investments are realized in years 2, 3 and 5 as shown in the following table. We assume that all of the realizations are distributed to LPs until carry can be taken by the GP.

In this example, the fund invests $100 million in three companies in year 1. The fund exits Company 1 in year 2, realizing $60 million. Company 2 goes bankrupt in year 2 and the fund realizes $0. Company 3 is exited in year 5 with the fund realizing $60 million. All in all, the fund realizes $120 million from its $100 million of investments, for a profit of $20 million. In the absence of a preferred return hurdle, the fund would earn $4 million in carry ($20 million in profit x 20% carry).

Now assume that the fund has an 8% preferred return hurdle. This means that the LPs must receive an 8% annualized return on their contributed capital before the GP can be paid any carry. In the above example, the LPs have contributed $100 million in year 1. This means that in year 2, the fund must distribute $108 million ($100 million x 1.08) to the LPs before the GP can take carry. In year 3, the fund must distribute $117 million ($100 million x 1.08 x 1.08) to the LPs before the GP can take carry. By year 5, the fund must distribute a total of $136 million to the LPs before the GP can take carry.

In Example 1, at the end of year 5 the fund has realized a total of $120 million from its investments for a total profit of $20 million. However, the preferred return hurdle requires the fund to distribute $136 million to the LPs before the GP can take any carry. Since the fund has only realized $120 million from its investments, it is below the $136 million hurdle needed for the GP to take carry. In this case, the GP does not receive any carry.

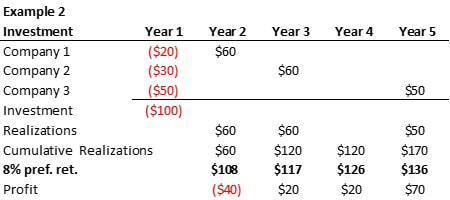

Example 2. Same example as above, with two differences. Instead of Company 2 going bankrupt in year 3, Company 2 is sold and the fund realizes $60 million. Also, Company 3 exits for $50 million in year 5. This means that over the life of the fund, the fund invests $100 million and realizes $170 million, for a gain of $70 million.

The question is then whether the preferred return hurdle is a “hard” hurdle or has a GP catchup. In a hard hurdle, the GP can only receive carry on amounts greater than the preferred return hurdle. In this case, in year 5 the fund has realized $170 million and the hurdle is $136 million. A hard hurdle means that the GP only takes carry on profits in excess of the hurdle, which is $34 million ($170 million - $136 million) for total carry of $6.8 million.

Now let's look at a GP Catchup. Let's assume the catchup calls for the GP to receive 100% of the profits after the hurdle is met until the GP "catches up" to having 20% of the total profit. In the above Example 2, if there was no hurdle, the GP would receive $14 million in carry through the end of year 5 ($70 million profit * 20% carry). As discussed above, with a hard hurdle, the GP only collects $6.8 million through year 5. With a GP catch up, in year 5 the LPs will have received $136 million in distributions from the hurdle. Since the hurdle is met, 100% of the profits above the hurdle go to the GP until the GP achieves its 20% carry. The profit above the hurdle in year 5 is $34 million. This means the GP would receive 100% of the profits until its 20% carry is met, so the GP would receive $14 million. At the end of year 5, the LPs would have received a total of $156 million in distributions ($100 return of capital and $56 million of gain), and the GP would have received a total of $14 million in carry (20% of $70 million profit). Note that the carry calculations are very complex and so this example has been simplified.

Additional Notes:

- Multiples. Some funds (such as fund-of-funds) use a multiple of contributed capital as the preferred return hurdle instead of an annualized percentage rate. In this case, the GP doesn’t take carry until the LPs have received, for example, 2x of their contributed capital.

- GP Priority in Catchup. Once the preferred return hurdle is met and the GP starts taking carry, it is customary for the GP to receive most, if not all, of the profit distributions until the GP as fully “caught up” on its carry. For example, the GP might receive 80% to 100% of all profit distributions as carry until it is caught up, and then all future distributions are shared 80% to the LPs and 20% to the GP.

- Distribution Waterfall. Until carry can be taken, LPs receive 100% of all distributions from the fund and the GP receives nothing (this may not be entirely true, but is beyond the scope of this post). Once carry can be taken, the GP and the LP share in the distributions as described above. Because of this, the mechanics of how the fund’s realizations and profits are distributed among the LPs and the GP are known as the “distribution waterfall.”