|

Emergence Capital, a Silicon Valley-based venture capital firm focused on the software-as-a-service sector, is profiled on WSJ.com. Emergence has just closed its third fund at $250 million. Emergence was early to identify the era of cloud computing and the software-as-a-service model. Here's the link: http://blogs.wsj.com/venturecapital/2012/02/29/as-business-software-moves-to-cloud-emergence-capital-closes-third-fund-at-250m/

0 Comments

VentureBeat recently posted an excellent article "A Classic Startup Horror Story: the M&A Bait and Switch." The article outlines the dangers of the small start-up sales process where a potential buyer learns the technology secrets of the small start-up and then does not complete the deal. What happens if the potential buyer then uses the Even if there's a non-disclosure agreement in place, the small start-up may not have the resources (or time) to pursue expensive and lengthy litigation. The second part of the article is a letter from the CEO of a start-up outlining his nightmare experience. Well worth a read, especially if you are the CEO of a small start-up looking to sell the company. Here's the link: http://venturebeat.com/2012/02/27/a-classic-startup-horror-story-the-ma-bait-and-switch/

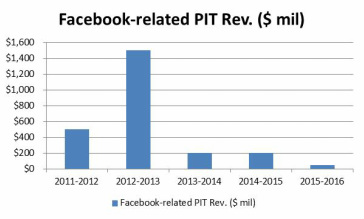

California's non-partisan Legislative Analyst's Office has released its 2012-13 budget update, which includes an estimate of the possible impact to the California budget by the initial public offering of Facebook. Facebook's IPO and subsequent stock sales by its employees are estimated to generate $2.45 billion in capital gains tax and other Personal Income Tax (PIT) revenue to California over a period of several years, and a whopping $1.5 billion in 2012-2013. Here's a chart showing the PIT revenue estimates to California from the Facebook IPO and subsequent stock sales: Just another reason to look forward to the Facebook IPO. Here's the link to the Legislative Analyst's Budget Update: http://www.lao.ca.gov/analysis/2012/update/economic-revenue-update-022712.aspx Wilson Sonsini Goodrich & Rosati, a leading law firm in the venture capital industry, has published its report on venture capital deal terms for the fourth quarter of 2011. The key take-away is that the median valuation for early stage financings jumped up to $8 million in 4Q2011 from $5.6 million in 3Q2011. The report has a lot of other interesting information on trends for specific deal terms such as liquidation preferences, anti-dilution provisions, etc. Here's the link: http://www.wsgr.com/publications/PDFSearch/entreport/Q42011/private-company-financing-trends.htm

peHUB has a couple of recent posts discussing the returns obtained by San Francisco Employees' Retirement System (SFERS) from its portfolio of venture capital funds. The most recent post has a slideshow of SFERS' returns from late stage venture capital and secondary funds. The earlier post has a slideshow of SFERS' returns from early stage funds. Both posts have some very interesting (and in a couple of cases surprising) data.

Here's the link to the post on returns from late stage and secondary venture capital funds: http://www.pehub.com/137641/late-stage-secondary-funds-strong-suit-for-san-francisco-pension-funds-venture-portfolio/ Here's the link to the post on returns from early stage venture capital funds: http://www.pehub.com/136326/california-pension-funds-diversified-approach-to-venture-appears-to-benefit-performance-slideshow/ Atomico, the London-based technology venture capital firm founded by a co-founder of Skype, is making investments in Brazil and has opened an office there, according to a recent article in NY Times DealBook. The article "Venture Firm Seeks the Atypical, and Finds it in Brazil" discusses Atomico's strategy in Brazil and the types of tech companies in which it invests. Interesting reading. Here's the link: http://dealbook.nytimes.com/2012/02/23/venture-firm-seeks-the-atypical-and-finds-it-in-brazil/

Atomico recently issued a press release on its Brazil investments. Link: http://www.atomico.com/news/uncategorized/atomico-announces-first-investments-in-brazil/ Bazaarvoice, an Austin, Texas based social media company that enables companies to collect and analyze online reviews and other feedback about their brands, had its first day of trading yesterday. It priced its initial public offering at $12 per share (above the indicated range of $8 to $10 per share), began trading yesterday at $15.77 and closed yesterday at $16.51, up 38% from the IPO price and 5% from the initial trade. The IPO raised nearly $114 million, for an IPO valuation of $683 million. The company netted $100.4 million from the IPO, selling shareholders netted $5.4 million and the underwriters received $8 million in fees (7% commission). Morgan Stanley, Deutsche Bank and Credit Suisse were joint-bookrunning managers (with Morgan in the coveted "lead left" position) and Piper Jaffray, Pacific Crest and BMO acting as co-managers.

Venture capital investors in Bazaarvoice include Austin Ventures (25.5% post-IPO ownership), Battery Ventures (13.9%), Eastern Advisors (9.2%), Constantin Partners, European Founders Fund and First Round Capital. Here's a link to the Bazaarvoice press release of the IPO: http://www.bazaarvoice.com/about/press-room/bazaarvoice-inc-prices-initial-public-offering Link to the IPO prospectus: http://www.sec.gov/Archives/edgar/data/1330421/000119312512076769/d213580d424b4.htm There's a good post on ReadWriteWeb called "Fast Times In East Berlin: Exploring Europe's New Startup Capital." The article discusses the development of East Berlin's start-up scene, and identifies some characteristics that make East Berlin attractive: inexpensive (compared to other cities), good infrastructure, and creative people from all over the world. The article also discusses some of the venture capital firms investing in tech start-ups there. Here's the link: http://www.readwriteweb.com/archives/berlin_europe_startup_capital.php

Ron Conway, uber-angel investor, was recently interviewed by CNET. In the interview, Ron discusses the health of the Silicon Valley economy, early-stage funding environment and new technologies and companies that interest him.

Here's the link: http://news.cnet.com/8301-13772_3-57383899-52/uber-angel-ron-conway-silicon-valley-is-stronger-than-ever/ Ron was recently profiled by Forbes, here's a link to my prior post with the story: http://www.allenlatta.com/1/post/2012/02/ron-conway-profile-forbes.html Robert Peck, the President and Partner of CoRise Co., LLC has an interesting article on Business Insider called "To Justify A $100 Billion Valuation, Facebook Has To Generate $400 Of Revenue Per Member." In this article, he discusses the value of Facebook from the perspective of the network. They derive a value per user implied by a $100 billion valuation, and then making assumptions regarding cost of capital, margins, growth rates, etc. determines the net present value of the revenues that the $100 billion valuation assumes for a Facebook user over its lifetime. It's a different take on valuation. Here's the link: http://www.businessinsider.com/to-justify-a-100-billion-valuation-facebook-has-to-generate-400-of-revenue-per-member-2012-2

On the heels of my prior post on San Francisco as Tech Central, here's another link to a blog post on medriscoll.com "Start-ups Belong in San Francisco." The post discusses some of the qualities that contribute to making San Francisco such a vibrant and unique place for the start-up scene. Worth a read. Here's the link: http://medriscoll.com/post/18137813025/start-ups-belong-in-san-francisco

Here's a link to my prior post on San Francisco: http://www.allenlatta.com/1/post/2012/02/san-francisco-as-tech-central-uncrunched.html In the Business Insider post "One VC Is Putting More Than $100 Million Into Big Data Startups -- Here's Why," Ping Li of Accel Partners discusses why Accel is so interested in the area. Its a good post and worth a read. Here's the link: http://www.businessinsider.com/this-vc-is-putting-more-than-100-million-into-big-data-startups-heres-why-2012-2

For more on Big Data, see my prior post: http://www.allenlatta.com/1/post/2012/02/venture-capital-sees-big-returns-in-big-data-reuters.html "Entrepreneurial activity is on the rise in Brazil and spreading into new industries." This is the opening sentence to an interesting post by Mark Boslet on peHUB "Entrepreneurship is Growing Up in Brazil and So Are Investment Opportunities." The posting goes on to discuss how Brazilian entrepreneurship is moving from software into new sectors and identifies investors targeting companies in Brazil, including Accel Partners.

Jim Breyer of Accel Partners discussed Brazil in a video interview last year, which can be found in a prior post here: http://www.allenlatta.com/1/post/2011/11/jim-breyer-interview-on-techcrunch.html Michael Arrington has a new post on his Uncrunched blog "San Francisco Or Palo Alto." In this post, he comments that over the past few years San Francisco has stolen the show from Palo Alto as the center of Tech and that The Creamery in South Of Market (SOMA) seems to be where a huge percentage of meetings are happening.

I have lived and worked in San Francisco for a dozen years and I have seen the ebb and flow of tech start-ups here. In the peak of the Internet bubble (circa 2000), SOMA was the home to numerous Internet and New Media start-ups. After the bubble burst, SOMA seemed to be quieter, but in the past five years, my sense is that San Francisco and SOMA have been re-energized. Here's a link to the post on Uncrunched: http://uncrunched.com/2012/02/21/san-francisco-or-palo-alto/ In the comments to the post, there's a link to a map of funded startups, which is also interesting. Here's the link: http://www.flickr.com/photos/alexmuse/6847577587/in/photostream/ Reuters has an interesting article "Silicon Valley: The Rise of the Adolescent CEOs" which examines the world of the under-21 year old entrepreneurs. These entrepreneurs have additional hurdles to jump, especially those under 18 years of age - for example, needing parents to act as co-signers on agreements. Here's the link: http://in.reuters.com/article/2012/02/21/venture-young-idINDEE81K04420120221

Vinod Khosla, the founder of Khosla Ventures, has an article on TechCrunch called "The 'Unhyped' New Areas in Internet and Mobile" in which he discusses twelve areas in Internet or Mobile he sees as "potential fishing ponds" that will be disruptive or take off. Some of these areas are: Big Data or Analytics; Education 2.0; TV 2.0; Health 2.0; and Utility Apps. Very interesting article. Here's the link: http://techcrunch.com/2012/02/19/unhyped-internet-and-mobile/

There's an interesting article by Sarah McBride on Reuters.com called "Venture Capital Sees Big Returns in Big Data" that's worth a read. In the article, Accel Partners' Ping Li outlines four themes for big data: (1) storage and networking services that support big data platforms; (2) platforms that enable the analysis of huge volumes of data; (3) big data apps; and (4) data-driven apps (data is used in a way that drives another app). Big data is garnering a lot of attention from venture capitalists these days, and this article provides some interesting background. Here's the link: http://www.reuters.com/article/2012/02/17/us-venture-bigdata-idUSTRE81G1HO20120217

Here are a couple prior posts regarding big data: Big Data 101: http://www.allenlatta.com/1/post/2012/02/big-data-101-nytimescom.html Start-Ups Tackling Big Data: http://www.allenlatta.com/1/post/2011/12/start-ups-tackling-big-data-nytimescom.html A recent study by Alexandra Michel of the University of Southern California explores whether working on Wall Street has an impact on health. In the study, Ms. Michel followed incoming associates at two investment banks for a period of nine years (she studied two incoming classes so the study is 10 years). Ms. Michel was herself an associate at a Wall Street bank before entering academia. The results of the study are interesting: in years 1 to 3, the associates were able to control their bodies and work up to 120 hours a week (in some cases) and be highly productive for the banks. However, beginning in year 4 the bodies started breaking down. Some of the ailments were colds, flu, heart problems, insomnia, cancer, alcoholism and depression. There's more to the study, but based on my experience as an investment banker, the study rings true.

Here's a link to a Los Angeles Times story on the study: http://www.latimes.com/business/money/la-fi-mo-wall-street-health-20120215,0,1521210.story?track=rss Here's a link to a Time magazine article on the study: http://business.time.com/2012/02/17/study-working-on-wall-street-is-bad-for-your-health/?iid=biz-main-lede Here's a link to the study: http://asq.sagepub.com/content/early/2012/01/30/0001839212437519.full.pdf+html Banker bonuses are down and bankers are having to adjust to the new realities, according to an article posted on WSJ.com. In "Honey, They Shrunk My Bonus" the spending habits of Wall Street bankers are examined in the new reality of lower cash bonuses. Interesting read, but my feeling is that this likely doesn't apply to star investment bankers. Failure to pay these stars market rate will mean that the talent will move to private firms where they can earn market rates without the public scrutiny. As a result, there could be a talent drain from the major bulge-bracket firms. Here's the link:

http://online.wsj.com/article/SB10001424052970204059804577227242488003760.html?mod=WSJ_hp_mostpop_read Legislation designed to make it easier for emerging growth companies to go public has advanced in the US House of Representatives, according to the Wall Street Journal. The legislation applies to companies that have less than $1 billion in annual revenue at the time they register for their IPO and that have under $700 million in publicly traded shares. These companies would for a period of time be exempt from certain provisions of Sarbanes-Oxley , which requires significant requirements regarding a company's internal controls.

In my view, this is a very good step towards addressing the IPO crisis in America. However, this legislation alone won't solve the problem and more work needs to be done. Additional areas that need to be addressed include: the broken business model for investment banks to support smaller public companies (inadequate compensation for investment banks's research departments that cover these companies and inadequate trading profits for investment banks that support these companies); the dearth of boutique investment banks servicing smaller companies (the bubble-era disappearance of the "four horsemen" - Hambrecht & Quist, Montgomery Securities, Alex. Brown and Robertson Stephens); and other regulations that have combined to effect the deterioration of the IPO market for smaller companies. Link to the Wall Street Journal article (full article requires subscription): http://online.wsj.com/article/SB10001424052970204880404577227853616803384.html?KEYWORDS=ipo+bill Yelp Inc., the local business review site, has set terms for its initial public offering. It plans to sell 7.15 million shares at a price range of $12 - $14, for maximum total IPO proceeds of $100 million and IPO market capitalization of $838 million (at the top of the range). The company is offering the vast majority of the shares in the offering (7.1 million) and 50,000 shares is being sold by the Yelp Foundation. Yelp formed the non-profit Yelp Foundation to support consumers and businesses in the markets in which it operates.

Goldman, Sachs is the lead bookrunning manager of the offering and Citigroup and Jefferies are joint bookrunning managers. Allen & Co. and Oppenheimer are co-managers. Venture capital investors in Yelp include Bessemer Venture Partners, Elevation Partners, Benchmark Capital and Duff Ackerman & Goodrich. Here's a link to Yelp's most recent S-1/A filing: http://www.sec.gov/Archives/edgar/data/1345016/000119312512065489/d245328ds1a.htm Jeff Bussgang, a General Partner at Flybridge Venture Capital, has posted an insightful presentation on the Boston Start-Up Scene on his blog, Seeing Both Sides. The presentation is "What Makes Boston's Start-Up Scene Special", and the link is here: http://bostonvcblog.typepad.com/vc/2012/02/what-makes-the-boston-start-up-scene-special.html

GigaOM has posted an interesting article about Las Vegas and its developing tech culture, which is being driven in part by the efforts of Tony Hsieh, the CEO of Zappos. The article is "An Inside Look at the High-Tech Awakening in Las Vegas" and the link is here: http://gigaom.com/2012/02/16/an-inside-look-at-the-high-tech-awakening-in-las-vegas/

DealBook has posted a good article on the lessons learned from Diamond Food's failed acquisition of Pringles. The article "The Lessons Learned From Diamond's Pringles Fiasco" can be found here: http://dealbook.nytimes.com/2012/02/15/lessons-learned-from-diamonds-pringle-debacle/

The article has a number of useful insights, including a short discussion of use of the MAC (Material Adverse Change) clause. The article is well worth a read. VentureBeat has posted an analysis of the performance of the venture-backed initial public offerings from 2010-2011. In its article "Buying IPO Stock? Might as well forget about rich returns" VentureBeat finds that venture IPO returns have lagged the S&P500. Here's the link: http://venturebeat.com/2012/02/14/buying-ipo-stock-might-as-well-forget-about-rich-returns/

The methodology for this analysis is flawed in my view. First the S&P 500 return from 1/1/2010 to 1/15/2012 is found to be 15.5%. Then the return for each venture-backed IPO is evaluated by the IPO price taken on the date of the IPO and the closing price on 1/15/2012. This analysis in my opinion is flawed because the timeframes for the returns don't match. To me, it would be more interesting to evaluate the return of each IPO for 180 days (when the lock-up expires) or 180 days after the IPO, and compare that return for the same dates. In this way one compares apples and apples. The result may be the same, but I believe it would be a more accurate barometer. |

About this Blog

This Blog is a collection of thoughts on a variety of topics of interest to me, including: Categories

All

Archives

January 2024

Copyright Notice:

All original works on this site are © Allen J. Latta. All rights reserved. Neither this website nor any portion thereof may be reproduced or used in any manner whatsoever without the express prior written permission of Allen J. Latta. LP Corner® is a registered trademark of Campton Private Equity Advisors. Used with permission. DISCLAIMER: Readers of this Blog are not to construe it as investment, legal, accounting or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Readers should consult with their own investment, legal, accounting, tax and other advisors to the determine the benefits and risks of any investment.

Private equity investments involve significant risks, including the loss of the entire investment. This Blog does not constitute an offer to sell or the solicitation of an offer to buy any security. |

Copyright © Allen J. Latta. All rights reserved.