Let's get started.

Post-Money Valuation = Pre-Money Valuation + Amount Raised

For more on pre- and post-money valuation, see the post “Pre-Money and Post-Money Valuation.”

Friends & Family Financing

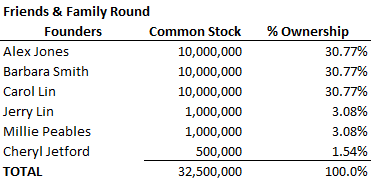

Lattamattic’s founders develop a limited beta version of the software. The company needs to raise money to build out the software and hire part-time coders to help. They want to raise $250,000 from friends and family. They demo the software to a few family members and close friends, and Carol’s uncle Jerry Lin decides to invest $100,000, Alex’s aunt Millie Peables invests $100,000, and a wealthy friend of Barbara’s, Cheryl Jetford invests $50,000. These “friends and family” investors purchase shares of common stock at $0.10 per share (a 1000x markup to the $0.0001 per share paid by the founders).

Here’s the cap table after the friends and family round:

- The friends and family investors receive ~7.7% of the company for their $250,000 investment.

- The founders’ ownership is diluted from 100% to ~92.3%.

- The post-money valuation is $3.25 million. Recall that the equation for calculating post-money valuation from the financing round information is:

Post-$ Valuation = Financing Proceeds / Post-Financing Ownership Percentage

- The pre-$ valuation (the value of the company immediately prior to the friends and family financing) is $3 million ($3.25 million post-$ valuation minus $325,000 financing proceeds)

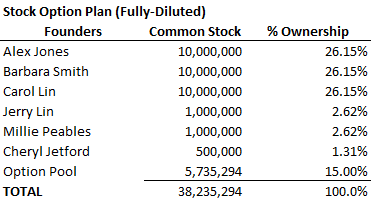

Option Pool

After the Friends & Family financing round, Lattamattic decides to establish a stock option pool so they can grant stock options to employees and consultants. Stock option plans generally run between 10% and 20% of a company’s fully diluted-equity. For more on stock options, see the post “Private Company Stock Option Plans: An Overview for Investors.” For a discussion of fully-diluted equity, see the post “Convertible Preferred Stock: Understanding the Conversion Feature.” Lattamattic decides to go with a 15% stock option pool. The cap table now looks like this:

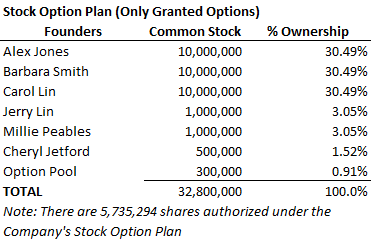

One issue is that the above cap table includes all of shares allocated to the stock option plan. But at this point in time, no stock options have been granted. So shouldn’t the number in the cap table be ZERO because no stock options have been granted? Yes and no.

Recall that a company allocates shares to the stock option plan – these are known as the stock option plan’s authorized shares. Once stock options have been granted, the option holder has a right, assuming certain conditions are met, to exercise the option and purchase the shares. This means there are three steps: (1) the company’s board of directors adopts a stock option plan and specifies how many shares of common stock are authorized under the plan; (2) the board of directors then grants options to employees, board members, advisors and consultants; and (3) options are exercised.

Many companies only include stock options that have been granted in the stock option pool line in the cap table, and either footnote the total authorized shares in the stock option plan or have a separate table showing the stock option plan. If Lattamattic took this approach, and had granted 300,000 stock options, the cap table would look like this:

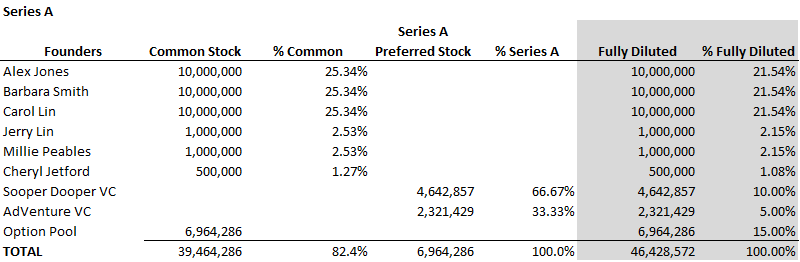

Series A Financing

Lattamattic continues to build the software and soon has a fully working version that is ready to sell to customers. The company now wants to raise $3 million in a Series A preferred stock financing from venture capitalists (“VCs”) to bring on more staff to fuel the growth. The company receives lots of interest from VCs, and accepts $2 million from Super Dooper VC and $1 million from AdVenture VC at a $20 million post-$ valuation. The terms for the Series A preferred stock financing include convertible into common stock, a 1x liquidation preference and a weighted average anti-dilution provision. The Series A investors also require the company to refresh the stock option pool so that it equals 15% of the post-money capitalization.

The cap table becomes more complicated now that we’re introducing convertible preferred stock that can convert into common stock. Because the Series A is convertible, the initial conversion ratio is 1:1, so unless there’s a later adjustment to this ratio (which can occur if there’s a down financing round and if certain other events occur), each share of Series A initially converts into one share of Common Stock.

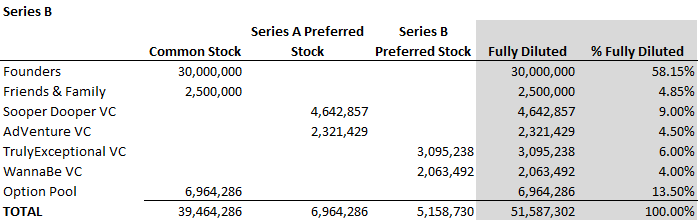

Lattamattic continues to be successful and soon raises a $50 million Series B convertible preferred financing led by TrulyExceptional VC investing $30 million and WannaBe VC investing $20 million at a $500 million post-$ valuation. Here’s the post-$ cap table:

Note that the cap table has changed. As the cap table became more complex, I’ve consolidated the founders into a “founders” line and the friends and family investors into a “Friends and Family” line to make it easier to read.

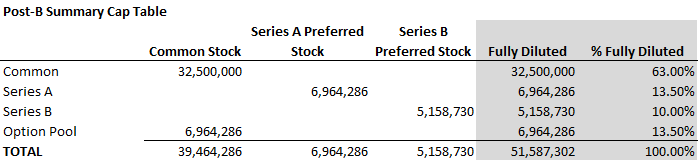

A summary cap table may combine all common stock holders together in a “common stock” line, combine the Series A investors in a “Series A” line and the Series B investors in a Series B line. Here’s what the summary cap table for Lattamattic would look like:

Notes and Take-Aways:

- Cap tables come in all sizes and flavors, from “summary” to incredibly complex.

- Investors want the cap table to show all authorized stock options to understand the total dilution if all of the options are issued and exercised.

- Cap tables used to be created on Excel, and many companies continue to use Excel for their cap tables. However, there are now many online cap table providers. Carta is probably the largest and best known of a crowded field.

++++++++++++++++++++

Methodology: Calculating the Size of the Stock Option Pool

This explains how we derived the size of the initial stock option pool.

We know that after the stock option pool is added that it will be 15% of the fully-diluted equity. So let P = Stock Option Pool and FD = Fully-Diluted Equity. This means that P = .15FD (the stock option pool is .15 or 15% of the fully-diluted equity after the stock option pool is added). We also know that the existing equity plus the stock option pool will equal the fully-diluted equity. Let E = existing equity. This means that E + P = FD. Using algebra and solving for P, we get:

P = .15FD

Substituting FD for E+P (recall E+P = FD) we get

P = .15(E+P), which equals P = .15E + .15P

Subtracting .15P from each side of the equation gives us

P – .15P = .15E or

.85P = .15E.

Dividing both sides by .85 gives us

P = (.15/.85)*E or

P = (3/17)*E

Plugging in E (which is existing shares prior to the addition of the pool, or 32,500,000 shares) gives us

P = (3/17)*32,500,000 or

P = 5,735,294

The generic formula is:

P = ((Pool Size as a % of Fully Diluted)/(1-Pool Size))*E

Where:

P = the number of shares allocated to the Stock Option Pool

E = the existing number of shares (before the addition of the pool)

© Allen J. Latta. All rights reserved.