I view dilution as having two components: ownership dilution and value dilution. These concepts are related. In this post, we’ll take a look at ownership dilution. We’ll look at value dilution in a later post.

Ownership dilution (also known as equity dilution) is when an investor’s equity ownership in a company decreases because of future issuances of equity. This can occur for many reasons, but is typically due to shares being issued in a new financing round, an increase in a stock option pool, and warrants or stock issued in connection with certain transactions.

Let’s use a simple example to illustrate this.

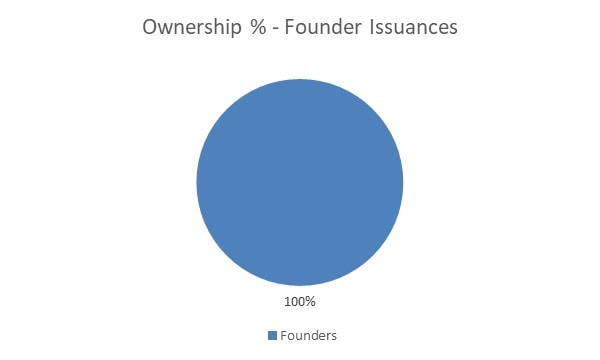

Assume that Lattamattic Corp. has two founders. After company issues the founders their shares, the ownership looks like this:

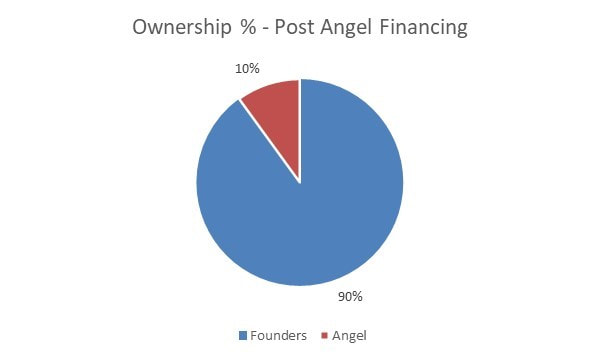

The founders then raise money from an angel investor who acquires 10% of the company. After this financing, the ownership looks like this:

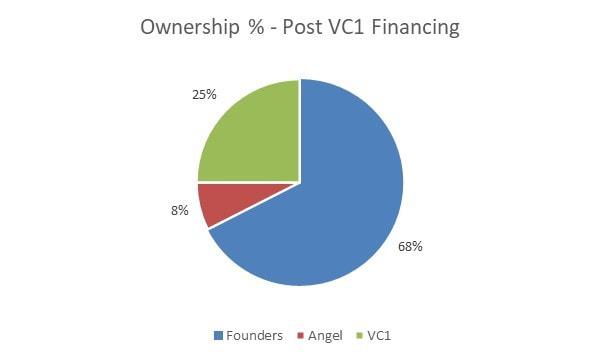

Some time later, the company raises money from a venture capital fund (VC1), which invests in exchange for 25% of the company. This financing dilutes the existing investors – the ownership of the founders and the angel investor is reduced. After the financing, the ownership looks like this:

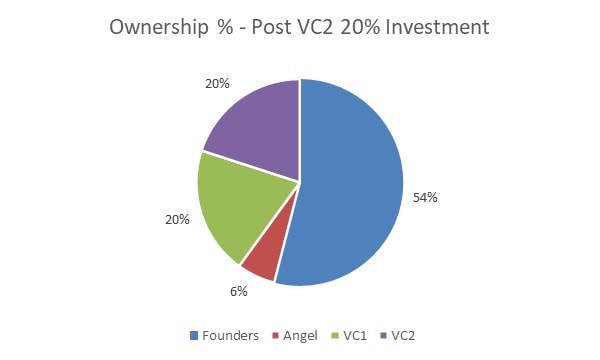

Let’s carry this forward again. The company grows quickly, and needs additional capital. The founders approach another venture capital fund (VC2) which invests in the company and receives 20% of the company. Because of this issuance, the founders, the angel and VC1 will all experience ownership diluted. Here’s the ownership after the VC2 financing:

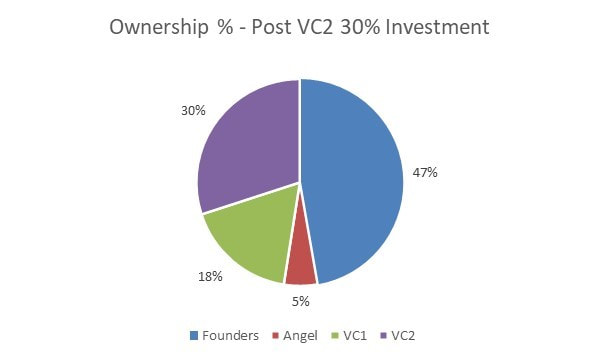

But what would happen if instead of VC2 acquiring 20% of the company, VC2 acquired 30% of the company? If VC2 acquires 30% of the company, the ownership after VC2’s investment would look like the following:

Why do Founders care about ownership dilution?

This is the danger of equity dilution for founders: as more equity in the company is issued, the founders will be diluted and could lose control of the company. If the founders lose control of the board of directors, the founders could be sidelined in the company (such as changing from CEO to CTO or other position), or in some cases forced out of the company altogether.

Why do VCs care about ownership dilution?

For a couple of reasons:

- As the company grows and becomes more profitable, its valuation will increase. VCs want to maintain their equity ownership in winners (by participating in later financing rounds), so the fund will profit as much as possible when the VC exits the investment.

- VCs also may have rights based on the level of ownership in the company, such as the right to elect a director to the board, and so the VC will want to maintain enough ownership to maintain these rights. Often, a VC will negotiate the right to elect a board member which will continue so long as the VC owns a certain number of shares of stock.

Why do LPs care about ownership dilution?

For the same reasons as the venture capital investor cares about dilution. LPs invest in a venture capital fund with the expectation of achieving a healthy return from the investment. LPs rely on the venture capitalists to generate this return, and one way VCs can enhance the returns to the fund is by maintaining ownership in a company and maintaining certain rights with the company.

Other Types of Ownership Dilution

Also, note that there are other ways founders and other stockholders can experience dilution.

- Stock Option Plans. Most venture capital-backed companies establish stock option plans for their employees. These stock option plans usually represent 15 to 20% of the company’s fully-diluted ownership at the time the plan is adopted. After a few years, and after additional financing rounds, the options may all have been granted, and the stock option plan will be “refreshed” to again represent 15-20% of the company’s fully-diluted equity.

- Warrants. Similar to options, warrants are rights to purchase stock of a company in the future at a certain price. Warrants are often granted to lenders and sometimes to other vendors.

How does an investor protect against ownership dilution?

The way investors protect themselves against equity dilution is to negotiate a “Right of First Offer” (also known as a “pre-emptive right”), so that when the company issues new shares, the investor would be able to participate in the financing in order to maintain their percentage ownership in the company.

So that’s equity dilution in a nutshell. In a later post, we’ll discuss value dilution, which is a more complex topic.

Links to other posts on dilution:

http://www.allenlatta.com/allens-blog/dilution-part-two-value-dilution

http://www.allenlatta.com/allens-blog/rights-of-first-offer-aka-pre-emptive-rights-an-overview

http://www.allenlatta.com/allens-blog/anti-dilution-protection-an-overview

© 2020 Allen J. Latta. All rights reserved.