As discussed in part one, I view dilution as having two components: ownership (equity) dilution and value dilution. These concepts are related. Let’s now explore value dilution.

Value dilution is when the value of an owner’s stake in a company decreases. This typically happens when the company has a later financing at a company valuation that is less than the valuation of the prior round.

We'll use an example to illustrate this. Our example will start off with financings that increase the value of the company and each existing owner's stake in the company. Our example will then finish with a financing that decreases the value of the company and each existing owner's stake in the company.

Example. Two smart grad students form a company JetsonLabs to develop industrial robots. Let’s assume that the founders paid $1,000 for 1,000,000 shares of common stock, which means they paid $0.001 per share for their stock. After the founders were issued their common stock, the ownership looked like this:

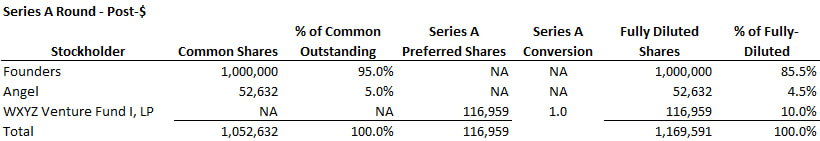

Now let’s look at a simple capitalization table for the company after this issuance:

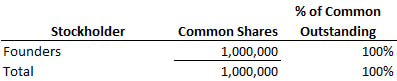

After this financing, the ownership looks like this:

But what of the value of their ownership stake? The post-$ valuation of the company is now $2 million, and they own 95% of the company. This implies that the value of the founders’ ownership is $1.9 million, up from the post-money valuation of $1,000 after they invested at the company’s inception. While the founders’ ownership has decreased, the value of their ownership has increased significantly.

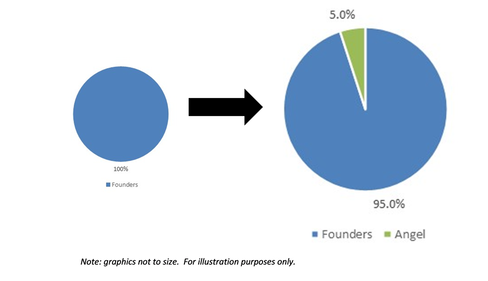

Growing Pie. Think of the company as a pie, with the size of the pie as the valuation and the slices of the pie as the ownership stakes in the pie. While the founder’s slice of the pie has gotten smaller (ownership decreased from 100% to 95%), the pie has grown dramatically (the value of their stake has grown from $1,000 to $1.9 million). See the graphic below.

A Note on Preferred Stock. Preferred stock is also equity, like common stock, but preferred stockholders have rights and privileges greater than those of the common stockholders. One of these rights is that the Series A Preferred Stock can convert into common stock at an established exchange ratio at the option of the Series A Preferred stockholders. For more on preferred stock, see the post “LP Corner: Understanding the “Equity” of Private Equity.” The Series A Preferred Stock initially converts into common stock at a 1:1 exchange ratio, meaning that the Series A Preferred stockholder would receive one share of common stock for each share of Series A Preferred Stock that was converted. This exchange ratio can change in a number of situations, which will be discussed in future posts.

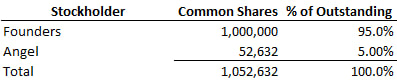

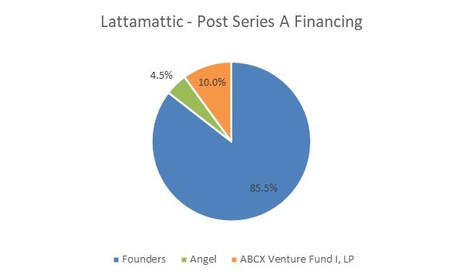

After the financing, the ownership looks like this:

Ownership (Equity) Dilution. After the venture capital financing the founders now own 85.5% of the company, down from the 90% owned after the angel round. So over two rounds of financing, the founders’ equity has gone from 100% to 90% to 85.5%. The angel investor has been diluted from 5% ownership to 4.5% ownership.

Value of Holdings. What about the value of the holdings? WXYZ invested $7 million in exchange for 10% of the company. This gives the company a value of $70 million. As the founders own 85.5% of the company, this means their stake is now worth nearly $60 million! That’s a significant jump up from the $1.9 million value after the angel round. What about the angel? His stock is now valued at over $3 million, a big bump up from the $100,000 he invested (a 30x multiple on investment).

This illustrates that equity dilution may not be a bad thing by itself if the company performs well and its valuation continues to rise.

But what happens if the company stumbles?

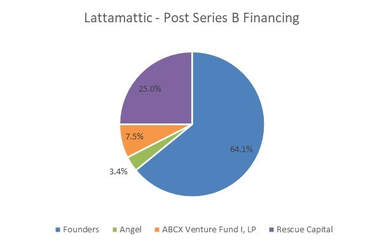

After the Series A Financing, JetsonLabs starts developing another model of the robot, but run into problems and the company soon needs additional capital. The founders approach WXYZ, but WXYZ passes on investing. The founders approach other venture capitalists, and Rescue Capital invests $5 million in JetsonLabs in exchange for 25% of the company in Series B Preferred stock. This means the post-Series B valuation of the company is now $20 million ($5/25%), down substantially from the $70 million post-$ valuation of the Series A round.

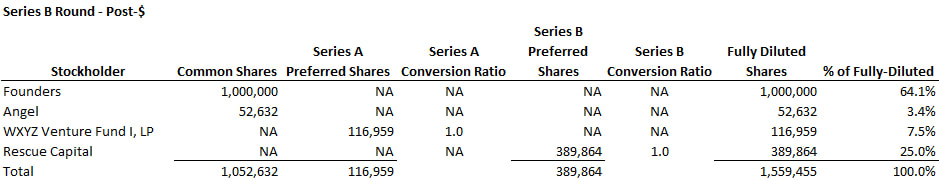

The chart below shows the ownership after the Series B financing.

The angel investor has been diluted to 3.4% ownership. The angel started with 10% ownership and now owns 3.4%.

Venture capital firm WXYZ saw its ownership be diluted from 10% to 7.5%.

Value of Holdings. This is where the real pain is felt. Rescue Capital invested $5 million in exchange for 25% of the company. This gives the company a value of $20 million. The founders now own 64.1% of the company, which means their stake is now worth $12.8 million. That’s a significant drop from the near $60 million value of their holdings after the Series A round.

What about the angel? His stock is now valued at $675,000, a big drop from the $3.15 million after the Series A round, but still up from the $100,000 he invested. The angel’s investment is now valued at 6.75x his investment, still not a bad outcome, but down from the 30x multiple after the Series A round.

Venture capital fund WXYZ is taking a hit on its investment. WXYZ invested $7 million in the Series A round, and that investment is now worth $1.5 million. That’s a loss of $5.5 million! The investment is now valued at .21x of the original investment. This means the fund is going to have to mark-down the investment on its financials and the overall performance of the WXYZ fund will be hurt. VCs (and the limited partners in their funds) don’t like mark-downs.

In this case, the founders, the angel and WXYZ all suffered ownership (equity) dilution as well as significant value dilution.

But as we will see in a future post, there are “anti-dilution” provisions that can help minimize the ownership and value dilution experienced by preferred stockholders.

Links to other posts on dilution:

http://www.allenlatta.com/allens-blog/dilution-part-one-understanding-ownership-dilution

http://www.allenlatta.com/allens-blog/rights-of-first-offer-aka-pre-emptive-rights-an-overview

http://www.allenlatta.com/allens-blog/anti-dilution-protection-an-overview

© 2020 Allen J. Latta. All rights reserved.