A liquidation preference is a priority payment right given to preferred stockholders when a company has a “liquidation” event – which means a sale of the company or the bankruptcy/winding down of the company. In the event of a liquidation, the liquidation preference determines how the liquidation proceeds are prioritized and paid to the preferred stockholders and the common stockholders. These payments are called a “liquidation waterfall.”

Liquidation preferences can be pretty complex, so let’s break this down into components.

A “liquidation” for purposes of these liquidation preferences fall into two categories:

- Business Failure. If a company fails, it goes through a legal procedure called dissolution. During a dissolution, the assets of the company are typically sold and the cash in the company is first paid to the company’s creditors and then if any cash is left over (often there is nothing left), the cash is paid to the preferred stockholders in accordance with the liquidation preference, and then if there is any cash remaining after the preferred stockholders are paid, then the common stockholders receive the remaining cash. Generally speaking, if an early-stage company fails, there’s very little to divide up among the preferred stockholders and the common stockholders.

- Sale or Merger of the Company. If a company is sold to or merges with another company, the proceeds from this sale or merger are subject to the liquidation preferences. A company sale includes the following transactions:

- Stock for cash. The acquiror (which an be a company or a private equity fund) pays cash for all of the target company’s outstanding stock.

- Stock for stock. The acquiror (in this case usually a publicly-traded company) purchases the stock of the target company in exchange for publicly-traded stock of the acquiror.

- Assets for cash. The acquiror buys substantially all of the target’s stock in exchange for cash.

- Assets for stock. This isn’t very common, but in this case the acquiror buys substantially all of the target’s assets in exchange for stock.

- Merger. This is a very common structure where the acquiror (or a subsidiary set up specifically for this purpose) merges with the target.

The main thing to know here is that a liquidation includes a sale of the company.

Option 1: Basic Liquidation Preference

The most basic form of liquidation preference is that the preferred stock holders receive their money back (or a multiple of their money back) before the common stockholders receive any payment. The multiple preference can be 1.0x (meaning the preferred stockholders receive their money back), 1.5x or 2x or even 3x, so that the preferred stock would receive the multiple of their money back before the common stockholders receive any payment.

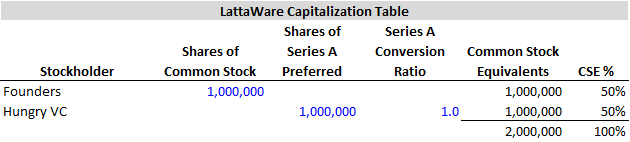

Multiple Example. Assume LattaWare sells 1 million shares of Series A Convertible Preferred Stock to Hungry VC at $1.00 per share, for a total investment of $1 million. The founders of LattaWare own 1 million shares of common stock. LattaWare’s (very simplified) capitalization table (“cap table”) is as follows:

A quick note on the cap table. Because the preferred stock is convertible, initially at a 1:1 ratio, the above cap table shows the “Common Stock Equivalents” to show what the ownership would be if the Series A Preferred stockholders were to convert their shares.

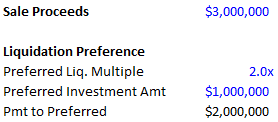

As part of the negotiations, Hungry VC negotiates a 2x liquidation preference. LattaWare is sold 7 years later for $3 million. Since a sale of the company is a “liquidation”, Hungry VC will receive its 2x liquidation preference of $2 million ($1 million investment * 2x liquidation preference) before the common stockholders receive the remaining $1 million.

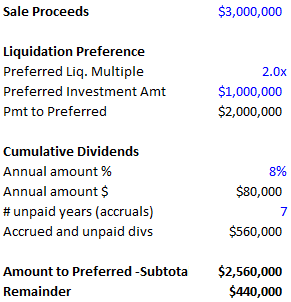

Dividends. Another consideration is dividends. Liquidation preferences negotiated by preferred stockholders typically include the payment of any accrued and unpaid dividends. If a preferred stockholder negotiates a cumulative dividend provision as part of the preferred stock financing, and the company has not paid any dividends, then in a liquidation, the preferred stockholders would receive the accrued and unpaid dividends as part of the liquidation preference. For more on dividends, please see the post “Preferred Stock Financings: Understanding Dividends.”

Dividend Example. Assume the same LattaWare example above, except that Hungry VC also negotiated an 8% cumulative dividend in addition to the 2x liquidation preference, and the company was sold at the end of year 7. In this case, after the company was sold for $3 million, Hungry VC would receive $2.56 million ($2 million plus the accrued but unpaid dividends of $560,000 (8% * $1 million * 7 years). After Hungry receives its $2.56 million, there’s $440,000 left for the common stockholders.

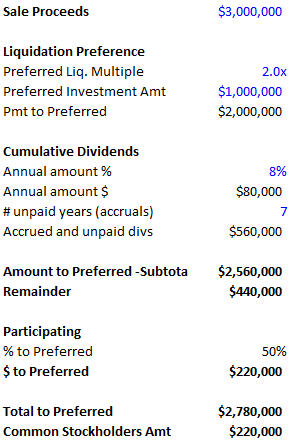

Another option is that after the preferred stock is paid its liquidation preference, it then participates in the remaining pool of money with the common stockholders. This is known as “participating preferred stock.” The way this works is that after the liquidation preference is paid to the preferred stockholders, the remaining pool of money is shared among the common stockholders and preferred stockholders. The calculation of how much is based on a the number of shares owned by the common stockholders and the number of common shares the preferred stockholders would own if their preferred stock was converted into common stock (known as “as converted” basis.

Participating Example. Using the same LattaWare example from above, assume the common stockholders owned 1 million shares. As before, Hungry VC invested $1 million in exchange for 1 million shares of preferred stock (convertible into common on a 1:1 basis), and obtained a 2x liquidation preference plus an 8% cumulative dividend. Now, in addition, assume Hungry VC negotiated participating preferred rights, so it shares in the money that is paid to the common stockholders. Here, Hungry VC would receive a total of $2.78 million and the common stockholders would receive $220,000.

Hungry VC’s payment has 3 components: (1) $2 million from the 2x preference; (2) $560,000 from the accrued and unpaid dividends; and (3) $220,000 from participating in the monies paid to the common stockholders. The $220,000 is calculated as follows: there’s $440,000 remaining after paying Hungry VC the 2x preference and accrued but unpaid dividends. From the cap table above, we know that the founders own 1 million shares of common stock, and the preferred stockholders own 1 million shares of common on an “as converted basis” (1 million shares of preferred stock converting on a 1:1 basis). For more on converting preferred stock into common stock, see the post “Convertible Preferred Stock: Understanding the Conversion Feature.”

Option 2: Capped Amount

Another option is to cap the amount that the preferred stockholders can receive in a liquidation. The purpose of this is to ensure that the common stockholders don’t get completely squeezed out from receiving proceeds from the sale of the company because of the preferred stock liquidation preferences.

The way this works is that the preferred stock would have participating preferred and the total amount the preferred could receive is capped at some total amount.

Cap Example. Continuing with the same example as above, except that the preferred stockholders have a cap of 20x of their investment, and the company is now sold for $100 million dollars. If there’s no cap, the preferred stockholders receive $51,280,000 and the founders receive $48,720,000. With a 20X cap, the preferred stockholders receive $20 million and the founders receive $80 million.

How Founders Can Start a Successful Company but Get Nothing When it is Sold

There has been the occasional story about how founders get nothing when their company is sold. How can this happen? It all depends on the liquidation preferences. Let’s use our LattaWare example. Same as above, except that Hungry VC negotiates a 5x liquidation preference and the company is sold for $5 million after one year. In this case, Hungry VC would receive all $5 million of the proceeds because of the liquidation preference and the founders would be shut out completely.

This is why it’s really important for entrepreneurs to have financial and legal counsel to guide them through financing rounds. Entrepreneurs need to understand the effects of ownership dilution as well as the nuances of preferred stock financing terms.

© Allen J. Latta. All rights reserved.