In a prior post, “Pre-Money and Post-Money Valuation,” we introduced the basics of pre-money valuation and post-money valuation and how they are related. This post expands that post to discuss the impact of option pool refreshes on pre- and post-$ valuations.

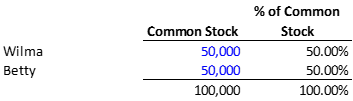

In the prior post, we looked at FlintRubble.com which was formed by Wilma and Betty. The two founders invested $5,000 each and received 50,000 shares. After the issuance, the ownership looks like this:

The above table is called a “capitalization table” or “cap table.”

The pre-money valuation here is zero because the company is just starting. The post-money valuation is $10,000 – the amount invested by Wilma and Betty.

Recall the equation for pre-and post-money valuation:

Pre-Money Valuation + Financing Proceeds = Post-Money Valuation

Here, the pre-money valuation is zero, the financing proceeds are $10,000 and so the post-money valuation is $10,000.

Angel Investment

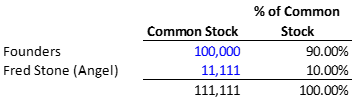

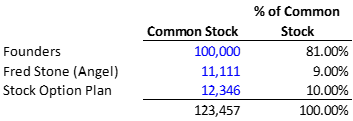

They then approach Fred Stone, a respected angel investor, and Fred invests $100,000 for 10% of the company. After Fred invests, the cap table looks like this:

What’s the post-money valuation here? Recall the equation:

Post-$ Valuation = Financing Proceeds / Post-Financing Ownership Percentage

Here the post-$ valuation is equal to the financing proceeds ($100,000) divided by the post-financing ownership percentage (10%), or $100,000/10% = $1 million. This means the company is now valued at $1 million. The founders own 90% of the company, and so their stake is valued at $900,000.

What’s the pre-money valuation? Remember the equation:

Pre-$ Valuation = Post-$ Valuation – Financing Proceeds

In this case, the pre-money valuation is $900,000 ($1 million post-$ valuation - $100,000 financing proceeds).

Stock Option Plan

Stock option plans are a way for companies to incentivize employees (and directors and consultants) to join the company, to stay at the company and to reward the employee for great job performance. For a discussion of Stock Option Plans, see the post “Private Company Stock Option Plans: An Overview for Investors.”

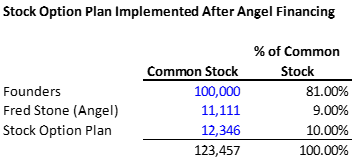

After the angel financing closes, let’s assume that Wilma and Betty want to hire some employees and want to give them stock options. In order to do this, the company must adopt a “Stock Option Plan.” FlintRubble.com adopts a Stock Option Plan equal to 10% of the outstanding shares.

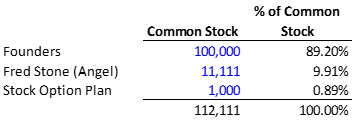

| +++++ NOTE: Do you include authorized or granted options in the cap table? Sometimes a company will only include the options that have been granted and not the entire number of authorized options. Assume that FlintRubble.com granted options to purchase 1,000 shares of common stock to an employee. If the company only showed the granted options, the cap table would look like this: The problem with the above cap table is that it gives Fred Stone a false impression of his ownership. As more options are granted, Fred (and the founders) will suffer ownership dilution. As an investor, I want to know what my total dilution will be from the stock option plan, which is why I want all authorized options to be included in the cap table. As an investor, you must confirm that the cap table shows the authorized shares under the stock option plan, not the granted options. +++++ |

By introducing the stock option plan AFTER the angel financing round, all existing investors are diluted.

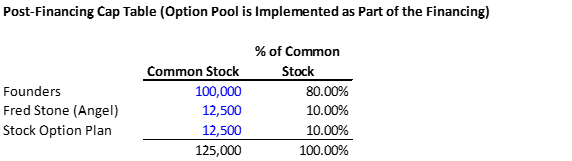

| +++++ NOTE: What if the option pool was implemented as part of the angel financing? What if the angel investor required the company to establish the stock option plan as part of his investment so that immediately AFTER the financing the angel would own 10% of the company and the option pool would represent 10% of the company? In that case, the cap table immediately after the angel financing would look like this: See the impact of implementing the stock option plan as part of the financing? The founders are diluted to 80%, and after the financing the angel investor owns 10%. The post-money valuation is the same - $1 million, but the pre-money valuation is now $800,000. Why is this? It’s because the stock option plan is now included in the financing and because the angel investor gets 10% of the company and the option pool is for 10% of the company, it means the investors in the company prior to the financing suffer all of the dilution. +++++ |

Series A Preferred Stock Financing

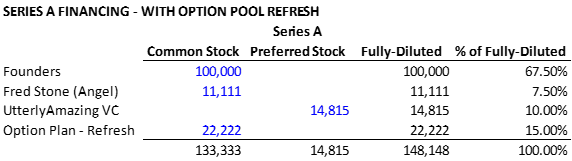

The company later approaches UtterlyAmazing Capital, a venture capital firm, and UtterlyAmazing thinks that FlintRubble.com will be a smash success. They invest $10 million in the company in exchange for 10% of the company post-financing. UtterlyAmazing purchases Series A preferred stock in this financing, and the Series A preferred stock converts into common stock at a 1:1 basis. But as part of the financing, UtterlyAmazing wants the stock option plan to be “refreshed” so that after the financing the stock option plan will equal 15% of the fully-diluted shares on a post-financing basis.

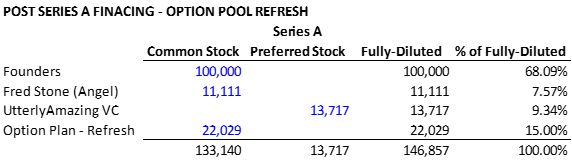

Here’s the cap table after the Series A financing and the option pool refresh:

But now notice what has happened to the prior investors: the founders have been diluted to 67.5% ownership, down from 81%, and the angel investor has been diluted to 7.5% down from 9%.

As previously discussed, the above process is called a “pre-money option pool refresh” because the increase in the option pool impacts all investors prior to the Series A financing. As a new investor, you don’t want to suffer dilution from an option pool refresh done as part of your investment, so this “pre-money” option pool refresh is how to prevent you from suffering dilution.

Because UtterlyAmazing invested $10 million for 10% of the company, we know the post-$ valuation is $10 million. If there was no option pool refresh, the pre-money valuation would be $9 million. But the option pool was refreshed by 5%. This means the pre-money valuation is $8.5 million, and all of the pre-Series A stockholders suffer all of the dilution.

Post-Money Option Pool Refresh

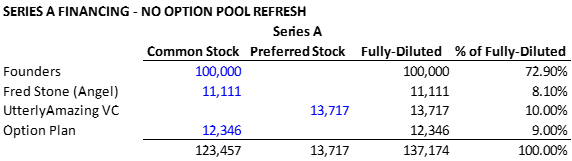

As we previously discussed, there’s another way to do the option pool as part of the Series A financing, and that’s to implement the pool after the round closes. This is known as a “post-money option pool refresh.” By doing this, everyone gets diluted, including the Series A investor. The first step here is to have the Series A financing, but not refresh the option pool. Here’s the cap table post-Series A financing with no option pool refresh:

Now, after the financing, the option pool is refreshed to be 15% of the capitalization. Here’s the cap table:

Note also that all investors suffer equity dilution by implementing the option pool refresh after the closing of the Series A financing. This result is better for the founders and the angel investor.

Summary

As a new investor in a company, you need to understand the impact of including an option pool or refreshing an option pool as part of the financing. Generally speaking, a new investor doesn’t want to suffer immediate dilution from having an option pool introduced or refreshed on a post-investment basis, and so new investors will want the option pool introduced or refreshed as part of the financing so the existing investors suffer the dilution.

But there’s a balance here. It is important to keep the founders and key employees incentivized in a company, and if these people suffer too much dilution as part of a financing, it could impact their motivation. This is why it’s important for both management and investors to understand the impact of option pool refreshes as part of a financing.

© Allen J. Latta. All rights reserved.