A related right is the Co-Sale right, also known as “tag-along” right or “take me along” right. A Co-Sale applies when an existing preferred stockholder in a privately-held company has received an offer from a potential buyer (known as a “third party”) to buy its stock. The Co-sale right enables existing stockholders to sell their stock alongside the selling stockholder in this transaction.

Let’s explore the mechanics of a Co-Sale right.

That’s where co-sale rights come in. A co-sale right would allow you to participate in the above transaction, and sell some of your shares to the strategic investor at the very high price offered.

Let’s use the example from the post on Rights of First Refusal to illustrate how co-sale rights work.

Example

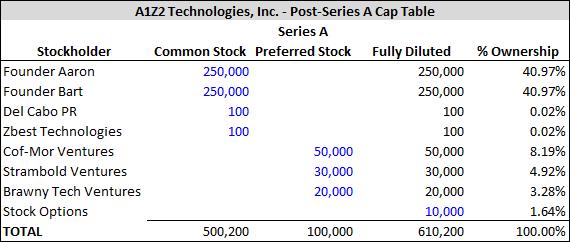

A1Z2 Technologies, Inc., an early-stage enterprise software company, has 2 founders who each own 250,000 shares of common stock. The company also issued 100 shares of common stock to two vendors who took stock in exchange for services. The company then held a Series A Convertible Preferred Stock financing and raised $1 million from three venture capital firms. In this Series A financing, the company issued 100,000 shares of Series A preferred stock to three investors at $10.00 per share. The company also has a stock option pool of 50,000 shares, of which 10,000 have been granted. Here’s the post-Series A cap table:

As part of the Series A financing, the investors obtained a ROFR and Co-Sale rights that covered all investors owning 20,000 shares or more (“major stockholders”). This means the founders and the venture capital investors are covered by the ROFR and Co-Sale Rights. The two vendors (with 100 shares each) and the stock options are excluded from the ROFR and Co-Sale rights.

As discussed in the prior post, the ROFR provides that the company and the major stockholders have the right to purchase any offered shares at the price and on the other terms of any offer. The Co-Sale right provides that the major stockholders have the right to participate in any third party offer to buy shares.

A year after the Series A financing, Brawny Tech Ventures receives an offer from Really Smart Ventures to buy all of Brawny Tech’s 20,000 Series A shares for $50.00 each in cash. This offer is five times what Brawny Tech paid and would be a great return for Brawny Tech. Brawny Tech sends a notice to the company about the offer. The company and the other major stockholders do not exercise their ROFR rights. As a result, the transaction can proceed, except that the Co-Sale right will now apply to the transaction. The Co-Sale right provides that each major investor can participate to its pro rata share of the offer.

Cof-Mor Ventures and Strambold Ventures both decide to exercise their co-sale rights and sell shares to Really Smart Ventures.

What this now means is that there’s an offer from Really Smart Ventures to buy all of Brawny Tech’s 20,000 shares of stock at $50 per share. The Co-Sale rights enable Cof-Mor and Strambold to participate in this transaction. The co-sale rights provide that each investor exercising its co-sale rights can participate with the selling stockholder to their pro rata (proportional) percentages.

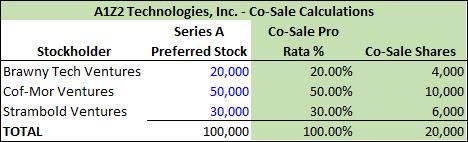

The table below shows the pro rata percentages for the co-sale right. The pro rata is calculated by the number of shares each investor exercising co-sale rights wants to sell in the transaction.

In this case Cof-Mor has 50,000 shares and Strambold has 30,000 shares. The offer is for only 20,000 shares. How do you determine how many shares each of Brawny Tech, Cof-Mor and Strambold can sell? By determining their pro rata portion of the offer.

Their pro rata portion of the offer is determined by adding up all of the shares owned by the selling stockholder and the major stockholders exercising their co-sale rights and determining each party’s percentage of the total amount. This is shown in the table below.

What happens if an investor doesn’t sell all of the shares it’s entitled to sell? For example, Strambold can sell up to 6,000 shares in the transaction, but what if it only wants to sell 1,000 shares? In that case the other stockholders can pick up the slack in their pro rata amounts.

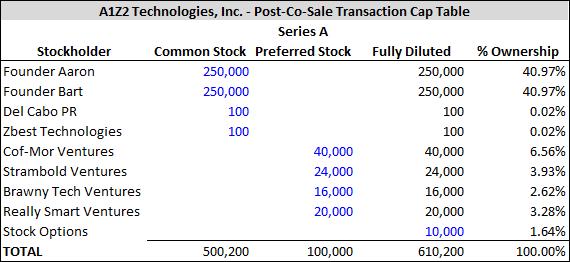

The post-transaction cap table for the company is as follows:

Notes

- ROFR and Co-Sale Usually Go Together. Most venture capital agreements give major preferred stock investors both ROFR and Co-Sale rights. One key take-away is that if you are an investor, you want to be included as a “major stockholder” so you get these rights.

- Excluded Transactions. Similar to ROFRs, there are often certain transactions that are excluded from the co-sale provisions, such as transfers to affiliates. For example, if an existing VC investor wants to transfer shares from one fund to another, this would be excluded from the co-sale provisions.

© Allen J. Latta. All rights reserved.