There are many elements to ROFOs. Let’s break them down.

ROFOs only protect against ownership (equity) dilution. ROFOs do not protect against value dilution. Ways to protect value dilution, which are called "anti-dilution provisions" will be discussed in later posts.

Let’s use an example to discuss ROFOs. Let’s say you are an angel investor and you own 20% of a start-up company. You want to maintain that ownership level so you will be able to influence the company and to reap the rewards of owning 20% of the company when it’s worth millions of dollars. But if the company issues additional stock in a financing round, or issues things that are convertible into stock such as stock options or warrants, then your 20% ownership stake will be diluted (decreased).

To protect against this ownership dilution, when you invested you negotiated for a ROFO to be in your financing documents.

In essence, what a right of first offer does is provide an existing investor in the company with the right to participate in a company financing to allow that investor to maintain its ownership percentage in the company.

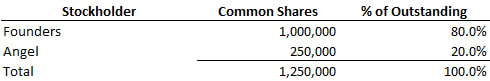

Using our example, when you invested in the company, you purchased 20% of the startup’s equity. The cap table looked like this:

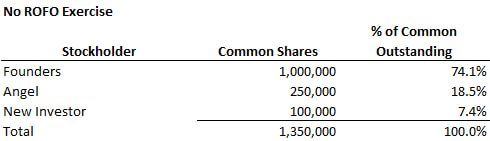

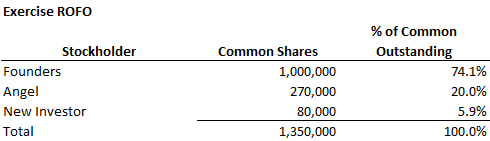

Now assume that you want to maintain your 20% ownership in the company and so you exercise your ROFR and you participate in the new round. This means that you will purchase 20% of the round, or 20,000 shares, at the $10 per share price, for a total investment of $200,000. After the financing, the cap table will look like this:

But wait, there’s more!

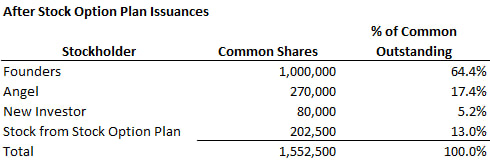

Carve-outs. ROFO provisions in contracts will typically contain carve-outs, meaning the company can make specified issuances of stock (or other securities) without triggering the ROFO. Put another way, certain issuances of securities are excluded from the ROFO. When the company issues these securities, because the ROFO does not get triggered, you will suffer dilution to your ownership position. Common carve-outs include issuances of stock options under a stock option plan, issuances of warrants to lenders as part of a debt financing, and issuances of warrants to equipment lessors as part of an equipment leasing transaction. Additional carve-outs that are more technical in nature include carve-outs for stock splits, issuance of stock dividends and conversions of preferred stock to common stock.

Using our example, after the last round in which you exercised your ROFO, the cap table looks like this:

Note: you will notice that the stock option plan was for 15% of the outstanding stock or 202,500 shares (1,350,000 shares x 15%), but after the stock has been issued, the stock issued under the stock option plan is only 13% of the outstanding stock. This is because the stock option plan was calculated on a pre-issuance basis. If the stock plan was to be 15% after the issuances, it would have been calculated on a post-issuance basis. Pre- and post- are very important terms in financings and care must be taken to fully understand the implications of stock being issued on a pre- or post-basis, and what that "basis" is. For a discussion on pre-money and post-money valuation, see the post "Pre-Money and Post-Money Valuation."

Major Investor Limitation. A company will want to limit the number of investors that have ROFOs. This is because working through the provisions of a ROFO with lots of investors is complicated and burdensome to the company. ROFOs are often only offered to “Major Investors” which may be defined as investors which own a minimum number of shares in the company. So if you don’t own enough shares to be a “Major Investor” then you may not have a ROFO.

Conclusion. ROFOs are very valuable and useful provisions that investors should negotiate for when investing in a company.

Links to other posts on dilution:

http://www.allenlatta.com/allens-blog/dilution-part-one-understanding-ownership-dilution

http://www.allenlatta.com/allens-blog/dilution-part-two-value-dilution

http://www.allenlatta.com/allens-blog/anti-dilution-protection-an-overview

© 2020 Allen J. Latta. All rights reserved.